PanJam sells 32m Sagicor shares - To pump proceeds into hotel project, other investments

PanJam Investments Limited has cashed in a small portion of its investment in Sagicor Group Jamaica, SJ, one of its most lucrative holdings.

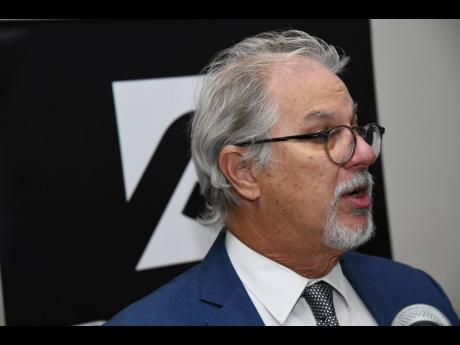

PanJam Chairman and CEO Stephen Facey says the proceeds from the liquidation of the 32.8 million SJ shares would finance ongoing projects. The price at which the shares were sold and the precise date of the disposal have not been disclosed, but those shares are currently worth $2.41 billion at SJ’s trading price of $73.62 on Thursday.

More immediately, the gain from the share disposal, which PanJam disclosed as amounting to $941 million, has served to boost the company’s June quarter bottom line profit, which tripled to $3.06 billion, compared with $988 million booked in the June 2018 period. Six-month profit doubled from $1.8 billion to $3.95 billion.

The Sagicor stock has dipped by $1.76 since Monday, but is still trading at double its $37 starting price for this calendar year. PanJam’s stock has climbed by more than $5 since Monday to $105.58 on Thursday.

The sale of the SJ shares has reduced PanJam’s stake in Sagicor Group by less than one percentage point from 31.56 per cent or 1.232 billion shares to 30.72 per cent or just under 1.2 billion shares.

PanJam will use the proceeds for different projects, including the renovation of the ROK Hotel & Residences, formerly Oceana Hotel, which is being redeveloped on the Kingston waterfront; development of property in Montego Bay, where the company previously disclosed it plans to build a hotel; as well as for “potential investments in regional, private entities,” Facey said in a statement appended to the PanJam’s June results.

Sagicor Group, which is led by president & CEO Christopher Zacca, reported record profits of $13.88 billion last year, and Facey says PanJam expects the insurance conglomerate to continue to do well.

“Sagicor has performed exceptionally well over the years, and we are confident in its long-term growth potential in a competitive and dynamic landscape,” he said.

Sagicor is typically the single largest contributor to PanJam’s profits. Attempts at direct comment from Facey and Vice-President Joanna Banks about the share disposal were unsuccessful.