Sharp rise in loan defaults as economy falters

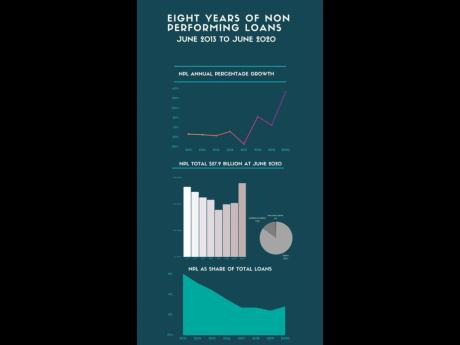

Unserviced bank and mortgage loans grew by one-third to $27.9 billion over the span of a year ending June, according to new central bank data.

It’s the highest percentage rise in eight years and, as a dollar value, grew by $7.5 billion from $20.4 billion a year earlier. The unserviced debt, also called non-performing loans, or NPLs, reflects the increased economic challenges faced by borrowers amid job losses and lay-offs linked to the coronavirus.

The growth in NPLs across commercial banks alone was 32.8 per cent, to $24 billion. The data did not disaggregate whether personal or commercial loans were hardest hit. Building societies, which distribute mortgage loans, saw their NPLs spike by 67.3 per cent to $3.9 billion.

The January-March 2020 period was the first quarter that witnessed a double-digit rise in NPLs in years, and the deterioration continued into the June quarter.

Jamaica’s economy has been contracting since the coronavirus was detected on the island in March. The June quarter was especially bad, having contracted 18.4 per cent as reported this week by the Statistical Institute of Jamaica, Statin – a historically dire performance. It affirmed the preliminary estimates of an 18 per cent second-quarter contraction by the Planning Institute of Jamaica.

Much of the decline resulted from the total lockdown of the tourism sector, which lasted over two months to mid-June.

Amid the deteriorating economy, a number of banks and lending institutions have offered moratoriums on loans which would have helped to keep NPLs at bay. The increased uncertainty and write-downs on loans, by banks in particular, resulted in the financial sector’s profit margin dropping from 23 per cent last year to 8.7 per cent for the June quarter, the Bank of Jamaica, BOJ, indicated.

Total loans grew 14 per cent across the financial sector to $957 billion as of June. That puts NPLs at 2.8 per cent of total loans, up from 2.4 per cent but still well within the 5.0 per cent threshold set by regulators. Comparatively, in 2012, NPLs were over 8 per cent of total loans; and in the 1990s, they at times represented half of the total loan portfolio.

BOJ, in its Quarterly Monetary Policy Report for the June 2020 quarter, said demand for personal loans has waned slightly as many persons had lost jobs due to the COVID-19 pandemic and were unable or less inclined to access loans.

“In the context of the adverse impact of the novel coronavirus, Bank of Jamaica projects that labour market conditions will worsen over the next eight quarters,” stated the central bank, explaining that the unemployment rate, or UER, is projected to rise from 7.5 per cent in 2019 to 10 per cent in June 2020, and to 12 per cent in March 2022.

Statin, which does a quarterly jobs survey, has put those reports on hold since the pandemic. The statistical agency last reported on jobs in January, pre-COVID, when the UER was estimated at 7.3 per cent.

Lenders had reported to the central bank in its credit survey that on average, they would have reduced interest rates on new local currency loans, making it cheaper to borrow. The reduced rates were expected to be applied to loans for microbusinesses, but there was no word in relation to personal loans.

BOJ data for July indicated that commercial banks were issuing personal loans at an average of 20.96 per cent, down from 21.79 a year earlier; mortgages, at 7.47 per cent, are down from 7.88 per cent; while commercial loans, at 9.52 per cent, were one point lower that the 10.52 per cent rate that prevailed a year earlier.

Overall, the weighted average loan rate for July was 12 per cent, down from 13 per cent.

Non-performing loans over 8 years:

June 2020 $27.9 billion

June 2019 $20.4 billion

June 2018 $19.9 billion

June 2017 $17.8 billion

June 2016 $21.6 billion

June 2015 $22.5 billion

June 2014 $24.6 billion

June 2013 $26.5 billion

Rate of NPL growth over 8 years:

June 2020 up 6.7%

June 2019 up 2.4%

June 2018 up 11.3%

June 2017 down 17%

June 2016 down 4.1%

June 2015 down 8.4%

June 2014 down 7.4%

June 2013 down 6.7%

NPLs as share of total loans:

June 2020 2.8%

June 2019 2.4%

June 2018 2.7%

June 2017 2.7%

June 2016 3.5%

June 2015 4.4%

June 2014 5.1%

June 2013 6.0%