Jamaican Teas posts loss despite big revenue growth

Tea and other consumer products manufacturer, Jamaican Teas Limited, which has branched out into retail, real estate and other investments, is reporting a near $70-million loss on group activities for the year ending September 30, 2020. This is despite its manufacturing arm declaring a near $258-million profit for the period. Losses on the portfolio of its spin-off investment subsidiary, QWI, continue to weigh down the group’s financial performance.

Jamaican Teas CEO John Mahfood says a $482-million fair value loss on revaluation of investments put a damper on big gains in operating revenue.

“That represents the fall in the value of shares in the QWI portfolio. We had a pretty sizeable loss for the first three quarters, but that moderated by Q4 and we ended up with a profit there. We’ve seen a turnaround in the fortunes of QWI and the shareholders there should feel better when we release those results in February,” he told the Financial Gleaner.

Jamaican Teas Group posted 70 per cent more gross revenues for financial year 2020 over 2019. Revenues totalled approximately $2.2 billion, some $904 million more than the roughly $1.3 billion for 2019. Exports was the best segment performer, contributing $860 million, or 39 per cent of revenues. This was followed by domestic sales at $546.5 million, or just under 25 per cent. Retail sales from its Bay City Foods supermarket brought in $534.47 million, or 24 per cent; while sale and rental of properties contributed $254.44 million, or 11.59 per cent, according to notes accompanying the year-end financials.

OVERSEAS MARKETS

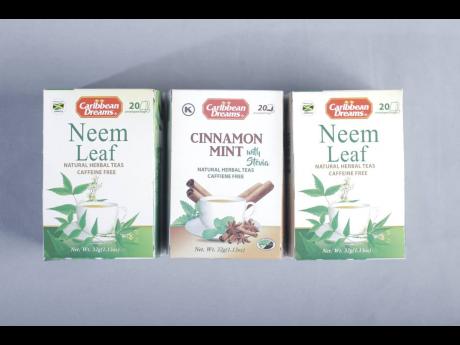

Exports were up nearly 49 per cent year-on-year, while domestic sales were flat. Mahfood said the company is paying keen attention to its overseas markets while innovating to maintain its local market position. He is of the view that with the performance of the local market and the leadership position of Jamaican Teas’ products, the headroom for growth will have to come from overseas.

“We can’t rely only on Jamaica in looking for growth. We already have the position of market leader, so the real growth has to come from the overseas markets, where there is more room to grow,” Mahfood said, adding that the export push will include Trinidad & Tobago.

“Despite payment problems in that market, it is still doing well. We are aware that their economy has been hit hard by lower oil prices. We think it is an important market to keep in touch with, because in the event of a turnaround, we want to be first in line to grab the further opportunities,” he added.

Jamaican Teas announced in November that it will be expanding its factory space at Bell Road in Kingston, adding 50 per cent more production capacity.

Meanwhile, in order to boost production, Mahfood said more workers will be hired. Administration expenses were $228 million for 2020, just about $14 million more than the previous year. Expenses are projected to go up further, given the need to spend more to meet demand.

“We’re moving to put in another shift rather than rely on overtime. To do that, however, we have to put in more management to cope with the increased production and productivity requirements,” according to Mahfood.