NHT interest reduction to cost $105 million yearly

The cost of the lowering of interest rate by one per cent on all categories of National Housing Trust (NHT) loans has been estimated at $105 million per annum.

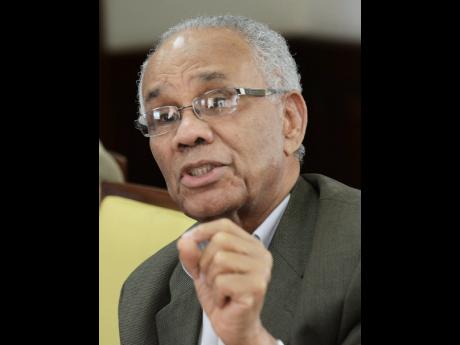

NHT Chairman Dr Carlton Davis told The Gleaner last week that the policy change, which sees a reduction in interest rates and an increase in the loan ceiling from $4.5 million per contributor to $5.5 million, has been under consideration for a long time.

He said detailed consideration on the policy, announced last Wednesday, commenced in May 2015.

"The Policy Committee met, deliberated and made recommendations to the NHT board, which approved the proposals on August 13, 2015. The Cabinet of Jamaica approved the recommendations on November 2, 2015," Davis told The Gleaner via email on Wednesday.

He said the reduction in interest rates and the increase in loan ceiling would not impact the viability of the NHT.

According to Davis, the decision was made after careful assessment of the relevant areas, which include annual contributions refund payments; peril insurance reserve; annual operating expenses; annual construction expenses; mortgage loan requirements; and the $11.4-billion contribution that the NHT is required to provide to the national Budget up to March 2017.

In 2013, Parliament passed a law that required the NHT to pay over $11.4 billion annually to the Consolidated Fund to provide budgetary support as part of a precondition for the Government to get an agreement with the International Monetary Fund.

Davis said the recommendations were based on "a thorough and complete assessment of the NHT's financial position".

"Care was taken to ensure that the NHT remains a viable going concern," Davis said.

"The review took several months and incorporated the results of simulations that covered every likely operating situation up to March 2018."

MOST CHALLENGING PERIOD

He told The Gleaner that the most challenging period for the NHT would be between now and March 31, 2017, when the requirements to provide fiscal support end.

Under the new policy, beneficiaries earning up to $7,500 weekly will now enjoy home loans at zero per cent interest, while at the upper end, persons earning more than $20,000 weekly will repay loans at a rate of six per cent. The NHT said the applicants to benefit from the increased loan limit are those who are buying properties in new housing developments, as well as those constructing new housing units.

According to Davis, the main objective is to stimulate activity in the construction industry while improving the contributors' access to housing.