COVID drives surge in e-commerce - Businesses make push to rake in online cash as foot traffic falls

More local businesses are pushing to expand their offerings online – some launching online stores for the first time – in a bid to ramp up sales by offering customers more convenient shopping options as the COVID-19 pandemic continues to dampen economic activity.

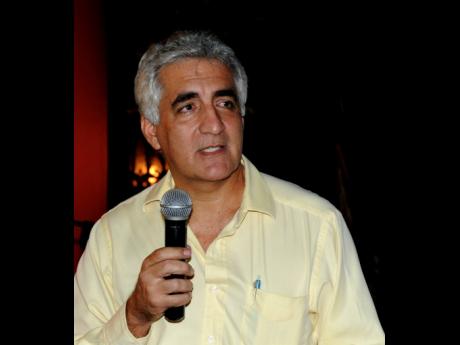

GraceKennedy CEO Don Wehby said that he is anticipating that a large portion of revenue for his company will come from its online sales platforms in the future.

Pointing out that the food business has been doing well under the circumstances, Wehby said that the conglomerate now has a major project under way to roll out a fully automated online platform for its Hi-Lo Food Stores in a matter of weeks.

“Along with that, we are doing our kerbside pick-up, where shoppers can WhatsApp in their orders, but we’re going to make it seamless in terms of placing those orders on the website, which we are anticipating will bring in a big slice of future sales,” Wehby stated.

He said that research showed that it would not make sense for GraceKennedy to currently launch its own online platform in the overseas market although it is partnering with major retailers and supermarket chains in the United States, Canada, and the United Kingdom to offer products through their e-commerce platforms.

Restaurants Associates Limited (RAL), operators of the Burger King, Popeyes, and Little Caesar’s Pizza franchises, said that since the coronavirus was first detected in the island in March, it has managed to fast-track the launch of its delivery product, adding a kerbside option among its operations.

RAL said that while COVID-19 has affected its restaurants, through “decisive and proactive management”, it has successfully kept stores open and expanded the Burger King and Popeyes lines without resorting to lay-offs.

“The addition of delivery and curbside services has greatly augmented in-store pick-up-only services and contributed to the ongoing viability of the company,” RAL said in response to Gleaner queries.

Several retailers told The Gleaner that in-store sales have fallen off dramatically since March and they were banking on online shopping options to pull in greater revenue.

Michael Ammar Jr, who owns the Ammar’s chain of fashion stores, said that he was fine-tuning a site to be launched on Cyber Monday, November 30, making his foray into the e-commerce field.

“I think eventually, it will add a sizeable chunk to the bottom line, but it is going to take a while. A company like this carries over 200,000 different items. To load all of that on a website would take forever,” Ammar said. “So you won’t see more than 10 per cent of our offering online, and that is probably the standard right now in this kind of industry.”

In the interim, Ammar said the stores have been using WhatsApp to mitigate the loss of foot traffic into his stores, noting that it facilitates browsing, ordering, and kerbside or in-store pick-up of purchased items.

MasterCard data for Latin America and the Caribbean indicate that payments related to e-commerce increased by almost 10 percentage points between March and May in the early days of the pandemic, moving from 24 per cent to 33 per cent of total MasterCard transactions, as economies across the region began feeling the pinch.

Marcus Carmo, director for marketing and communications at MasterCard, Caribbean Division, told The Gleaner that the increase in e-commerce sales has been sustained.

He pointed out that it could take up to three years for an acceleration of 11 percentage points in online commerce in normal periods, pointing out that the use of contactless payment was growing.

“Thirty-five per cent of all payment are done virtually,” he said. “In-store payments are showing a big shift as well.”

MasterCard is the second-largest payment network, ranked behind Visa, in the global payments industry.

paul/clarke@gleanerjm.com