Insurers urged to tailor coverage for the poor

Insurance companies have been urged to create more “inclusive” coverage specifically tailored for low-income Jamaicans who have been adversely impacted by the coronavirus pandemic.

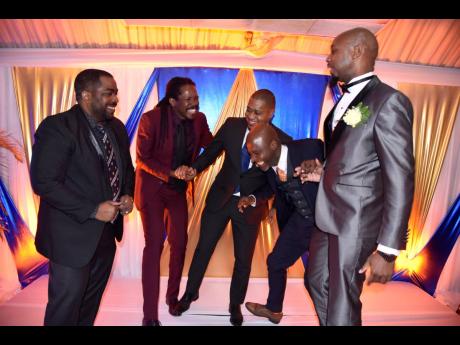

The call was made on Saturday by Opposition Senator Damion Crawford during his keynote address at an inauguration ceremony of the Jamaica Association of Insurance and Financial Advisors (JAIFA).

Almost 21 months since COVID-19 reached Jamaica’s shores, the economy has undergone a seesaw of fortunes after more than 130,000 jobs were haemorrhaged in the early quarters of the outbreak. Much of that ground has been regained, but Crawford raised an alarm that “some of the people who most need insurance are the people who least get sold”.

He expressed a concern that the COVID-19 pandemic had exposed the “underbelly” of Jamaican society, with many persons unable to seek professional medical treatment because they are not insured.

“There must be a concerted effort to design the types of packages for the people who are most in need,” Crawford told the audience.

“We feel that the insurance companies must ensure to take it as their duty to get more people included ... and, for more to be included, then the insurance packages must be all-inclusive.”

He is recommending a diversification of insurance packages on offer, including for those who struggle with mental-health conditions.

Citing how he and his family were able to bury his cancer-stricken father when he, Crawford, was 15, because of the existence of an insurance policy, Crawford appealed for more support for the poor.

He also raised a concern that many children are unable to continue attending school after the death of a parent, especially when the individual is the sole breadwinner of the family.

“The pursuit of life will always take priority over education if they cannot afford the pursuit of life,” he said.

In 2016, it was estimated that 32 per cent of adult Jamaicans reported having health insurance, but more than half of them, or 53 per cent, have coverage only because they are part of workplace schemes.

Crawford also encouraged insurers to customise payment strategies for workers who operate in the informal economy, including opportunities for premiums to be maintained weekly, for those who live hand to mouth, or tri-monthly for farmers.