Tracking the money

• Lack of paper trail, complex schemes, shell companies among difficulties faced to recoup swindled funds • Over $500m in a decade returned to victims of fraud, but billions unrecovered

More than $500 million has been returned to victims of fraud over the past decade, local authorities disclosed on Friday. The revelation comes amid fears that the alleged $3 billion fraud uncovered at the firm Stocks...

More than $500 million has been returned to victims of fraud over the past decade, local authorities disclosed on Friday.

The revelation comes amid fears that the alleged $3 billion fraud uncovered at the firm Stocks & Securities Limited (SSL) could land Jamaican sprint legend Usain Bolt and dozens of other investors in the same boat as tens of thousands of depositors who were swindled of their funds by operations in both the regulated and unregulated financial sectors.

It is estimated that more than 50,000 depositors in the top three unregulated investment, or Ponzi, schemes – Cash Plus, OLINT and World Wise – are still owed in excess of $20 billion, with little hopes of recovery.

At the same time, the Financial Investigations Division (FID) said that through collaboration with the Major Organised Crime and Anti-Corruption Agency (MOCA) and use of the Proceeds of Crime Act (POCA), it has confiscated and returned assets in a number of fraud cases. Among them, $100 million worth of assets to a businessman based in western Jamaica; $100 million to the Jamaica Teachers’ Association (JTA); and nearly $60 million to local conglomerate Facey Commodity Limited.

And the FID has already gone to court and obtained an order freezing assets worth millions of dollars that have been traced to Andrea Gordon, the former National Commercial Bank (NCB) senior manager serving a seven-year prison sentence for defrauding the financial institution of some $34 million.

The court is to rule on an application for the assets to be forfeited and turned over to NCB.

In the case of the western Jamaica businessman, his company was reportedly defrauded through an elaborate petroleum-stealing racket and the money used to acquire several assets, including real estate, Keith Darien, principal director of the FID, told The Sunday Gleaner.

“At the end of the day, it was agreed that the assets would be returned to the businessman’s company,” Darien said.

The assets turned over to the JTA include three St Andrew homes, which the accused fraudster, former accounting clerk Marlon Francis, purchased in his name and the names of his mother and aunt.

A three-storey seven-bedroom mansion erected in Ewarton, St Catherine, was turned over to Facey Commodity Limited after investigations revealed that it was financed through the proceeds of a $50-million phonecard scam orchestrated by a former employee, Shauna Lee Tucker.

Tucker was convicted for money laundering and slapped with a $3 million fine.

Further, the FID said US authorities have obtained a forfeiture order for over US$5,000 as well as jewellery, which were seized from popular Jamaican disc-jockey ZJ Wah Wa, whose real name is Deon-ville O’Hara, after his arrest there on lottery scam-related charges. O’Hara has since been convicted.

A house registered in the name of his mother, which investigators claim was extensively renovated with proceeds from his criminal conduct, has also landed in the crosshairs of local and American law enforcement authorities.

“We are now trying to have that sorted out,” Darien said.

In the case of the current sprawling SSL probe, the FID principal director said the investigation is in a very early stage.

“The investigation is trying to find out what exists that we can forfeit and return to the victims, but we are at no stage near that at this point,” Darien said during an interview on Friday.

Experts have, however, cautioned that the muddled affairs unfolding at SSL mean that Bolt and the other investors, much like Cash Plus depositors, may have to wait years to know if they will recoup their losses.

Last week, attorneys for the sprint legend gave SSL a 10-day ultimatum to return more than US$12 million reportedly defrauded from his account or face legal action. The ultimatum expires on Friday, January 27. Bolt has been doing business with SSL for 10 years and has one of the largest portfolios with the firm.

ONE OF THE LARGEST FINANCIAL FALLOUTS IN MODERN JAMAICAN HISTORY

In the mid-2000s, the lure of unusually high interest rates triggered an explosion in the number of unregulated investment schemes operating in Jamaica.

With a market share of about 46 per cent, Cash Plus was easily the largest of at least 16 such schemes that were in operation at the time, according to a 2008 study conducted by the Caribbean Policy Research Institute.

But their operations began crumbling under tighter monitoring by the Financial Services Commission (FSC) and pressure from commercial banks, triggering one of the largest financial fallouts in modern Jamaican history.

The Offices of the Government Trustee (OGT), which is also the liquidator of assets owned by Cash Plus, acknowledged, in a public statement on July 6, 2017, that approximately J$827.5 million and US$1.16 million had been recovered mainly from rental income, the sale of properties and payments made to settle liabilities owed to the Cash Plus Group.

Those funds, the OGT said, were insufficient to cover day-to-day expenses such as payments to interim employees and priority statutory deductions which must be paid before depositors.

Thousands of investors, including Jamaicans, lost more than US$220 million in the failed OLINT scheme. And it is estimated that World Wise investors lost approximately $200 million.

The majority of the victims are yet to recover any of the funds.

Responding to questions submitted by The Sunday Gleaner on Friday, the OGT said there are various classes of creditors “and the depositors are one such class”.

“The liquidation advances with a view to declare a dividend to all classes of creditors. Moreover, the exercise of this liquidation is complex, multi-jurisdictional, extensive and resource extensive,” the agency noted.

By comparison, the United States Department of Justice announced last September that it commenced an eighth round of pay-outs to victims of the billion-dollar Ponzi scheme orchestrated by late American financier Bernard Madoff.

At the time of his arrest in December 2008, the Bernard L Madoff Investment Scheme (BLMIS) had fleeced over 40,000 investors in 125 countries of over US$7 billion, according to US authorities.

A total of US$372 million is to be distributed among victims in the latest pay-out.

And in September 2021, a court-appointed receiver for the US$7.2 billion Ponzi scheme orchestrated by Texas financier Allen Stanford announced that a total of US$1 billion had been recovered for distribution to victims.

Stanford is serving a 110-year prison sentence for the fraud, which was uncovered in 2009 and impacted approximately 18,000 investors.

OLINT, WORLD WISE, CASH PLUS

David Smith, the former OLINT boss, was never prosecuted in Jamaica, though he was convicted for money laundering and other criminal offences in the US and the Turks and Caicos Islands (TCI).

Smith was released from a TCI prison in October 2020 after serving 10 years, authorities there confirmed.

World Wise founder Noel Strachan left Jamaica for the US after the scheme folded and has denied operating a Ponzi scheme.

In an exclusive interview with this newspaper in 2015, Strachan laughed at claims that he used investors’ money to purchase a private jet, several luxury vehicles and pricey real estate, including a million-dollar home in Florida.

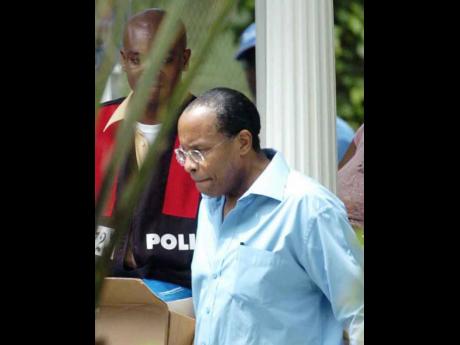

Cash Plus boss Carlos Hill was charged with fraudulently inducing investors, but the disappearance of a key prosecution witness caused his trial to quickly collapse after years of delay.

Adley Duncan, a former prosecutor in the case, told The Sunday Gleaner last week that there was evidence to support a claim that Cash Plus was not solvent enough to fulfil the promised return on investment.

“The company was not in a position to fulfil what Mr Hill was promising and Mr Hill would have known that because of the meetings he had, what was told to him, and his acquaintance with the company’s financials,” claimed Duncan.

But he said an accountant and other technical employees who provided witness statements did not show up to give evidence in court.

“We had statements from investors, but those statements were helpful only up to a point because we had to prove not only that the promises were made, … but that the promises could not be made good on and that the person [making the promise] knew that they could not be made good,” said Duncan, explaining the decision to set the former Cash Plus boss free in 2017.

MULTIPLE LAYERS TO HIDE FUNDS

According to the FID principal director, low-level fraudsters typically use their ill-gotten gains to finance “normal household expenditures”, while those involved in high-stakes fraud generally seek to acquire assets, including real estate and motor vehicles.

Part of the challenge for financial investigators, he said, is that in most cases, these assets are registered jointly or solely in the names of relatives or associates.

“When they do that, it becomes extremely difficult to prove that they own the assets,” Darien said.

“Because they are stealing cash and passing the cash to persons who, in turn, make the purchases, you won’t have any paper trail to show that monies flowed from the victim’s account directly to the vendor,” he added.

In more sophisticated cases, the FID principal director said, shell companies registered outside of Jamaica are used to hold assets.

“We are aware of one case involving someone [accused] of involving in small arms trafficking owning properties in Jamaica and using a shell company established elsewhere to own that property,” he said.

“We are looking at other cases involving the use of that technique.”

But Darien said as part of the efforts to stamp out this practice, the Companies Act is to be amended to mandate full disclosure of the “beneficial owners” of a foreign entity seeking to set up shop in Jamaica.

“So where you have multiple layers of companies involved – Company A is owned by Company B, Company B is owned by Company C – if you are registering Company A in Jamaica, it will no longer be sufficient to say it is owned by Company B,” he explained.

“The rules that will be promulgated under the new Companies Act will want to know the individuals that are ultimately behind these companies.”

Breaches of this new provision will be a criminal offence.