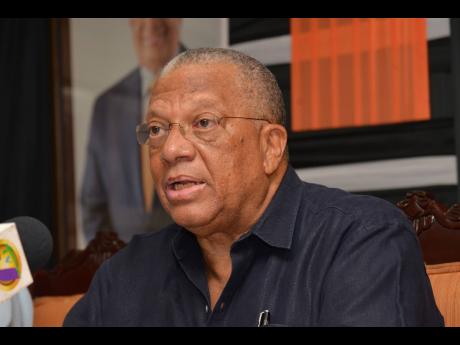

FSC took action against SSL – Peter Phillips

Former Minister of Finance Dr Peter Phillips says the Financial Services Commission (FSC) took action against investment firm Stocks & Securities Limited (SSL), which is now at the centre of a $3-billion fraud affecting dozens of its clients.

Phillips, who served in the portfolio under the Portia Simpson Miller-led Government between 2012 and 2016, disclosed on Tuesday that he was made aware of the now decade-old problems within the brokerage house.

However, he said as evidenced by a slew of directives issued in a 2013 letter to then CEO and President Mark Croskery, the board acted.

He said that it was customary for him to meet with all chairmen of the various agencies for which he had responsibility.

“I would have been made aware of the actions that the FSC intended to take and would, in the normal course of things, have had no intentions to change their course of action,” he told The Gleaner.

“That was captured in the letter of 2013,” he added, noting that as far as he is aware, actions were taken against SSL.

Phillips had said a week ago that he did not immediately recall whether he had been fully briefed on SSL’s parlous financial state.

In the October 2013 letter, SSL was told to refrain from accepting new securities business; dealing in securities; granting credit to other parties or related persons; and soliciting business from members of the public. It was also ordered to provide all information, documents, records, access, other assistance, and cooperation to any special auditor appointed by the FSC.

The directives were additions to those issued on January 3, 2013, when the commission wrote to Croskery instructing that SSL refrain from purchasing or acquiring any assets that would affect the balance sheet of the company without the FSC’s approval or except to comply with directives given.

Among the directives was also the requirement of a detailed listing of all on-balance sheet repo liabilities and corresponding assets used to collateralise contracts to be provided to the FSC.

Additionally, the FSC required a detailed listing of all off-balance sheet portfolios/contracts to include the beneficiary, description, and value of assets within each portfolio/contract.

The FSC also instructed that by January 15, 2013, the directors of SSL should have ensured that sufficient capital is injected into the company, allowing it to satisfy the relevant benchmark relating to the ratio of capital to risk-based assets and other risk exposures.