Millennials lose out! - Low financial literacy among young people impacts homeownership

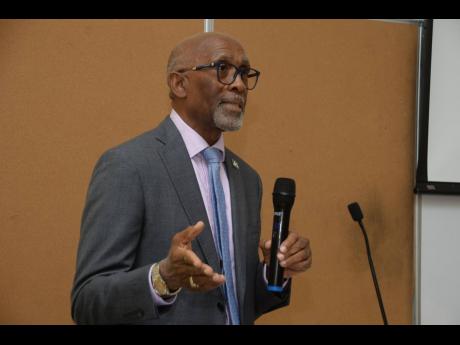

Carlton Earl Samuels, chief development financing officer of the Jamaica National Group, is of the view that low levels of financial literacy among young people classified as millennials may be impeding their ability to own property and create wealth for themselves.

Millennials are recognised as the generation born between 1980 and1995.

He made the point recently while addressing a panel discussion about the housing sector at the University of Technology (UTech), Jamaica, under the theme:, ‘The Housing Sector as a Seller’s Market and the Affordable Ways in Which this Market Can Be Made to Accommodate Millennials.’

Samuels argued that although there are growing opportunities in the real estate market, particularly at the middle-income level, many millennials are not prepared to take advantage of them because they are not sufficiently financially literate. He noted that financial literacy appeared to be especially low among millennials born in the 1990s, many of whom are now entering the job market and do not have a basic understanding of the mortgage process, savings, and investment.

Citing the National Endowment for Financial Education in the United States, which earlier this year found that only 24 per cent of millennials demonstrated basic financial-literacy skills, Samuels said that while no local data was available, he believed that the situation in Jamaica may be similar.

He indicated that the focus for many millennials is first to acquire a depreciating asset, such as a motor vehicle, soon after they start working, which he said was not always necessary.

Samuels asserted that some millennials are not saving or investing and were therefore, unprepared for the costs involved in purchasing property, such as the deposit for the property or the funds to close the mortgage.

He noted that the unpreparedness of millennials to acquire property is despite the fact that many of them are tertiary educated and earning about nine per cent more than the general labour force.

“Our own recent survey of a group of millennials indicated that 78 per cent of those surveyed are tertiary-educated and are earning between $1 million and $5 million,” he said.

Samuels acknowledged, however, that many are saddled by student loan debts and that not all are thriving because of the generally low economic growth over the decades, although the climate is improving.

However, Samuels maintained that improving financial-literacy levels could improve attitudes of thrift and investment among young people and noted that the Jamaica National Group, through its BeWise financial empowerment programme and the JN Way initiative in tertiary institutions, has been assisting to empower young people.

Beyond financial-literacy levels, however, Dr Carol Archer, associate professor in the Faculty of the Built Environment at UTech, who was one of the panellists, argued that housing prices are growing out of the reach of many.

“The research is showing globally, not just here in Jamaica, but there is a strong possibility that a number of you will be living with your family members, most likely your parents, for years to come,” she said.