GM made $10b last year despite autoworkers strike

General Motors' net income rose 12% last year despite losing more than US$1 billion when many of its plants were shut down by a six-week autoworkers' strike. The company also announced that it will bring back some plug-in gas-electric hybrids as electric vehicle sales growth slows.

The Detroit automaker made just over US$10 billion last year, up from US$8.9 billion in 2022. Excluding one-time items, the company made US$7.68 per share, easily surpassing the US$7.57 projected on Wall Street, according to FactSet.

Full-year revenue was US$171.84 billion, about 10% more than in 2022. That also beat estimates of US$167.26 billion.

The company predicts a small improvement in earnings this year even as it plans for lower vehicle selling prices due to increased discounts.

GM said it expects that net income will improve a little this year to a range of US$9.8 billion to US$11.2 billion. It expects adjusted earnings per share in a range of US$8.50 to US$9.50, compared with US$7.68 last year.

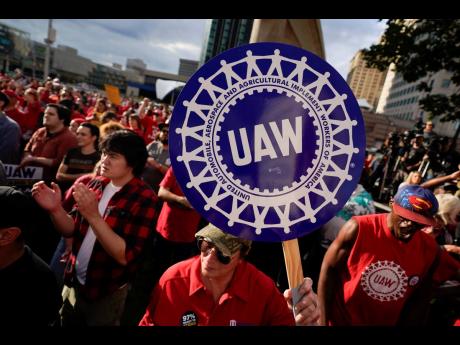

Due to US$12.3 billion in North American pre-tax profits, about 45,000 members of the United Auto Workers will get profit-sharing checks of US$12,250, the company said.

Chief Financial Officer Paul Jacobson told reporters that GM is preparing for a 2% to 2.5% average sales price drop on vehicles this year compared to last year as inventory grows amid high interest rates. GM has planned for price cuts for the past couple of years, but they haven't materialised, he said.

“It's not actually what we're seeing in the market today,” Jacobson said, adding that average sale prices “are actually holding up very similar to where we saw the end of 2023.”

Prices are stable for both internal combustion and electric vehicles, he said, bucking industry trends. He said GM plans to keep a 50-to-60-day supply of vehicles at US dealers, enough to supply demand but limit discounting.

That may be difficult with inventory from all automakers growing to 2.7 million at the end of last year, edging closer to pre-pandemic levels of around 3.5 million.

Without giving much detail, CEO Mary Barra said the company is bringing back some plug-in gas-electric hybrid models in the US, reversing a strategy to focus on electric vehicles. She told analysts on a recent conference call that GM would resurrect the plug-in hybrid powertrains on selected vehicles in North America, in part to help comply with more stringent fuel economy requirements that will start in 2027 in the US.

Plug-in hybrids can go a relatively short distance on battery power before a gas-electric propulsion system kicks in.

GM, Barra said, is still committed to eliminating tailpipe emissions from light-duty vehicles by 2035. “But in the interim, deploying plug-in technology in strategic segments will deliver some of the environmental benefits of EVs as the nation continues to build its charging infrastructure,” she said.

She didn't give a date for the hybrid comeback but said it can happen efficiently because the technology is already being produced in other markets.

Michelle Krebs, executive analyst for Cox Automotive, said she has always disagreed with GM's strategy to stop selling hybrids in the US.

EVs require consumers to make a huge change in driving habits, especially when traveling, Krebs said. “A lot of people aren't ready for that,” she said. Hybrids, she said, still let people fill up at gas stations as they do now. “You've got that confidence that you can get to places without charging up,” she said.

Growth in hybrid sales outpaced electric vehicle growth in the US last year as environmentally conscious consumers bought them because of concerns over electric-vehicle range and too few charging stations. Charging stations are being built with government incentives, and automakers are rolling out more EV models of all shapes and sizes.

GM struggled to produce electric vehicles in the past, so it will need to fall back on hybrids to meet fuel economy standards, Krebs said.

But Jacobson said there is still strong demand for GM's EV products that are on sale now. The company expects EV losses to ease this year and hit low-to-mid single digit profit margins in 2025 as it adds more EVs to its line-up.

GM plans to sell 200,000 to 300,000 EVs this year in North America, but Barra said it would adjust if needed. “It's true that the pace of EV growth has slowed, which has created some uncertainty. We will build to demand,” Jacobson said.

Jacobson also said that cost cutting by simplifying engineering and manufacturing saved GM about USUS$1 billion last year, with another USUS$1 billion expected this year.

During last year, GM lost US$1.1 billion from the UAW strike, plus it booked US$800 million in costs from a large Chevrolet Bolt EV battery recall. It also took a US$1.7 billion accounting charge on the valuation of its electric vehicle inventory that is going to bring losses, Jacobson said. Those expenses won't occur in 2024, he said.

The company also expects to spend US$1 billion less on its troubled Cruise autonomous vehicle unit as it slows the rollout of self-driving robotaxis. The company lost US$2.7 billion before taxes at Cruise last year.

This year, the company expects US$1.3 billion in higher labour costs and is prepared for about a US$3 billion hit due to lower prices, Jacobson said.

In the fourth quarter, GM made US$2.08 billion, up 4.5% from a year earlier. Without one-time items, the company made US$1.24 per share, 8 cents more than analysts estimated.