Finsac selling controlling stake in Ciboney Group

Finsac is seeking buyers for its 72 per cent stake in Ciboney Group, totalling more than 393 million shares, having written off most of the company's debt, and eliminated some of its deficits, using proceeds from the sale of its sole landholding.

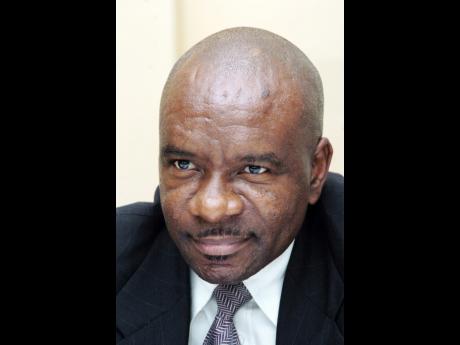

Finsac has invited proposals from buyers of the shares by April 30, and Errol Campbell, general manager of the Financial Sector Adjustment Company Limited, or Finsac, is already reporting expressions of interest.

"The proposed sale of Finsac's 72 per cent shareholding is with a view to return the company to private ownership, so a business venture may be pursued and create employment and value for its new owners and minority shareholders," said Campbell on Monday.

Ciboney was one of the assets taken over by Finsac under the bailout programme mounted by the Jamaican government in the 1990s to rescue the financial sector. The hotel company remained listed throughout and is currently trading at 11 cents per share, which values Finsac's holding at $43 million.

Campbell declined to comment on the price at which Finsac aims to sell its shareholdings. The stock traded at a high of 42 cents year to date, or four times its current price.

Ciboney had been racking up losses for years as Finsac waited for the right offer for the company's last remaining asset a 16-acre swathe of land at Culloden in Westmoreland that it finally sold for $250 million last December to an unknown entity called Green Forest Limited. Campbell again declined to provide additional information on Green Forest, but said the company was not interested in owning Ciboney.

Resulting from the land sale, Ciboney's deficits were reduced by more than one-half, while its capital base has turned around from a negative $47 million to a positive $205 million, according to its newly released third-quarter financial report for the period ending February 2018.

Subsequent to the quarter, on March 9, Ciboney distributed $185.64 million, or 34 cents per share, to shareholders from the land sale proceeds.

Asked the value of Ciboney in its present state to a new investor, the Finsac GM said it provides ready access to the market.

"Yes, Ciboney Group is a shell company but the buyer benefits from the fact that the company is listed on the JSE and so if it wishes it could raise funding for a business venture using this route. A purchaser would therefore not have to go through the trouble and expense of establishing a new company and getting it listed on the JSE," said Campbell, who is also chairman of Ciboney.

He adds that the sale of the shares is already generating interest.

"We are aware of some persons who are interested in purchasing the listed company on the JSE ... You will note that we advertised the shareholding and invited offers on April 30, at which point we will know precisely all who are interested in purchasing," he said.

Ciboney Group was formerly invested in hotel properties, which were sold off to repay debt, leaving the Culloden landholding as its single primary asset, that is, up to its December sale. Ciboney owed Finsac $99 million, $74.45 million of which has been forgiven by the bailout Finsac, while the balance has been settled from land sale proceeds, Campbell said. The eliminated debt was booked in the February quarter.