Jam Teas mulls another split

When the board of junior market beverage company Jamaican Teas Limited meets on January 14, the directors will consider two subjects: a possible increase in the authorised share capital of the company and a sub-division of the companies issued and outstanding shares.

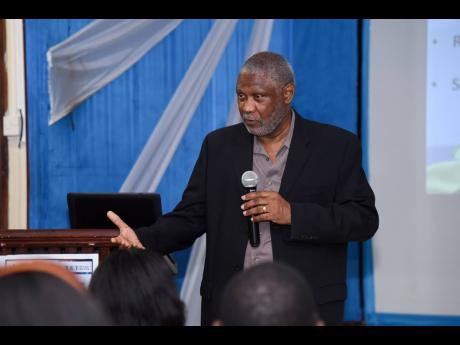

Chairman John Jackson says the tea maker will be asking shareholders to approve a stock split at the company’s next annual general meeting usually held around March or April.

He told the Financial Gleaner that the board has become concerned that the company’s stock seems to have hit a wall of inactivity and market indifference. Jamaican Teas has been there before and it has implemented stock splits at different times to get over the hurdle.

“There seems to be market resistance at some level. Whenever the stock hits $6-$7 then trading seems to stall and we don’t know what that reason is,” Jackson told the Financial Gleaner when contacted after the January 7, 2020 notice was posted on the Jamaica Stock Exchange website.

Since April 2018, JAMT’s share price has meandered between $4 and $6, going close to the $7 barrier only twice last year, on August 5 and September 9. Volumes have not been inspiring and the market has not been showing the stock much love, according to Jackson. He feels the price assigned by the market to JAMT shares is symptomatic of under-appreciation.

“Jamaican Teas shares are trading at a P/E of 10 or so with earnings per share of about 60 cents. The junior market is averaging about 20 times. That means ideally Jamaican Teas should be trading at about $12,” said Jackson, a financial analyst.

“There is clearly a resistance, whatever the reasons may be,” he added.

Jamaican’s Teas last stock split was in 2017. Various companies on both the junior and main markets utilise the strategy to unlock value in illiquid stocks. Jamaica’s stock market has twice since 2015 been rated the best performing worldwide and Jackson gives credit to the stock splits for helping to drive up the market.

“Jamaicans seem to love stock splits. Indeed the time when our stock market was rated the best performing coincided with when we had stock splits and this boosted trading activity,” Jackson said.

He adds that splits are good for the company and its shareholders, and wants the message to continue to be that the JAMT stock is a good buy.

“I always tell shareholders that if we consider where we’re coming from and where we are going, then I consider it a growth stock that should continue to perform, in that we should continue to see improvement in revenues and profits as we go along,” he said. “Stock splits and stock bonuses are oftentimes a precursor to improved fortunes ahead for companies.”