Deutsche Bank penalised for Epstein dealings

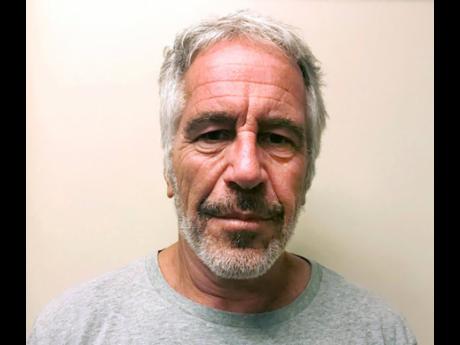

Deutsche Bank has agreed to pay US$150 million to settle claims that it broke compliance rules in its dealings with the late sex offender Jeffrey Epstein, New York state announced Tuesday.

The penalty was announced in a release by Superintendent of Financial Services Linda A. Lacewell.

“Despite knowing Mr Epstein’s terrible criminal history, the bank inexcusably failed to detect or prevent millions of dollars of suspicious transactions,” Lacewell said.

According to the release, the agreement marked the first enforcement action by a regulator against a financial institution for dealings with the financier.

Epstein killed himself last August in a Manhattan federal jail while awaiting trial on sex-trafficking charges.

His ex-girlfriend, British socialite Ghislaine Maxwell, was arrested last week and brought to New York City to face charges she recruited girls for Epstein to sexually abuse in the 1990s. In civil lawsuits, she has denied involvement. Her Manhattan federal court arraignment is likely next week.

In a statement, the German bank said the settlement with New York state “reflects our unreserved and transparent cooperation with our regulator”.

The bank said it had invested almost US$1 billion to improve its training and controls and had boosted its staff overseeing the work, to more than 1,500 employees, “to continue enhancing our anti-financial crime capabilities”.

In a statement, New York Governor Andrew Cuomo, a Democrat, said the bank failed to prevent millions of dollars in suspicious transactions.

Lacewell said the bank failed to properly monitor Epstein’s account activity despite publicly available information about Epstein’s crimes.

The financier, with US residences in Manhattan, Florida and New Mexico, along with homes in Paris and the Virgin Islands, had pleaded guilty to criminal sex-abuse charges in Florida over a decade ago and was a registered sex offender before his July 2019 arrest on federal sex crime charges.

Lacewell said the bank processed hundreds of transactions totalling millions of dollars that, “at the very least, should have prompted additional scrutiny in light of Mr Epstein’s history”.

She said some payments that should have drawn scrutiny included money paid to people publicly alleged to have been Mr Epstein’s co-conspirators in sexually abusing young women; settlement payments totalling over US$7 million; and over US$6 million in legal fees for Epstein and co-conspirators.

Other payments went to Russian models and transactions for women’s school tuition, hotel and rent expenses, she said, along with suspicious cash withdrawals totalling over US$800,000 in a four-year stretch.

AP