Mystic Mountain seeks reprieve from bondholders

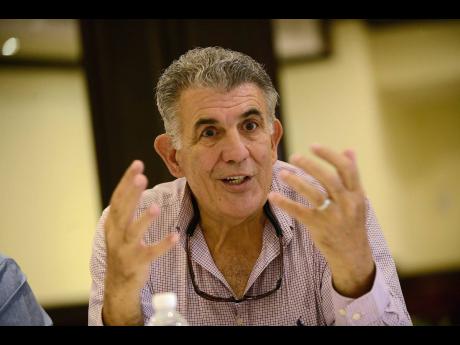

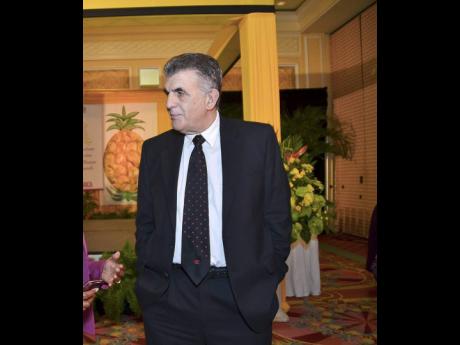

Michael Drakulich, principal owner and chief executive of the Mystic Mountain eco-attraction, will make another attempt today at convincing bondholders to delay interest and principal payments on its US$8-million bond for at least a year as the company tries to recover from COVID-19 losses.

Discussions between Drakulich and the bondholders – mainly made up of pension funds – got started in March when the company realised it had difficulty completing construction of a new area of the park called Reggae Ridge.

A total of US$6 million from the US$8-million debt raise was used to kick-start the project, with any additional funding needed for completion expected to come from Mystic’s cash flows.

But when the Government introduced measures to prevent the local spread of COVID-19, including the temporary restrictions on inbound travel, it forced the closure of Mystic Mountain, which is dependent on tourist traffic, and threw Drakulich’s plans into a tailspin.

“Because of the fallout with COVID-19, I went to the bondholders in March and asked for a waiver of the interest and to let us use the money from our debt-service reserve account to complete the construction. They said no,” he told the Financial Gleaner.

“But I felt it important to complete the project so that we could capitalise on pent-up energy when the economy reopened, and I went ahead and personally secured the funding of the completion at US$1 million,” he said.

Earlier this month, Drakulich reopened the adventure park to locals with an intake of a third of the park’s capacity of 2,400 individuals, in adherence to COVID-19 restrictions. But that’s not enough to get the company to break-even on its daily expenses right now, he said. Reggae Ridge, which was commissioned at Mystic’s reopening, features an inverted rollercoaster ride called Raggamuffin,, which is suspended 1,000 feet, or 305 metres, above ground, and all-electric eco ATV quad bike tours through the watershed.

Based on the original estimates, the expansion was projected to grow Mystics’ revenues by around 30 per cent over the next year, inclusive of earnings from night-time private functions in Reggae Ridge’s garden area.

US$1m receivables

The St Ann-based adventure park’s financial burdens are also compounded by the fact that Mystic Mountain still has over US$1 million of its March quarter receivables outstanding from tourism partners, whose businesses have also been hit by the pandemic.

Interest payable to bondholders has since been drawn down from the reserve account to fulfil coupon payments that became due in March and June.

Principal repayments on Mystic Mountain’s bond, which matures in 2025, are due to begin in December, but Drakulich is looking for a two-year reprieve.

“We’re asking that the principal payments be waived until December 2022, and we’ve asked that interest for now be waived for the next six months to a year, with all capitalised interest be repaid a year from now,” Drakulich said on Wednesday.

“We are hoping that proposal will be accepted as we enter an uncertain future. We have no cruise ship income, perhaps for the rest of this year, and the company may not reach 30 per cent of its normal revenue by December,” he said.

The extended timeline, according to Drakulich, would better fit with new plans by Mystic Mountain to gradually increase earnings as the Government continues its relaxation of COVID-19 restrictions.

“Currently, we are only taking locals, and if we do take tourists, it’s going to be on special days so that there is no mixing with the locals. But we can break even on our daily expenses of $3 million from just our local clients once things return to normal,” Drakulich said.

The seven-year bond issued in 2018 pays interest at 7.25 per cent per year. Mystic Mountain said at the time that it would spend US$6 million from the net proceeds on expansion of the park, which overlooks the resort town of Ocho Rios, while the rest would be split towards refinancing existing bonds and a debt-servicing account.

Regional credit rating agency CariCRIS, which on Tuesday downgraded Mystic Mountain’s creditworthiness to weak, said the company was currently in breach of its requirement to maintain a balance in its debt-service reserve account equivalent to six months’ interest payments. June’s payment from the account brought it down to only a one-quarter or three-month buffer.

CariCRIS also revised the outlook for Mystic Mountain from stable to negative and warned that if negotiations with the bondholders are not successfully concluded by November 30, the company could see a further lowering of its ratings.

“Should the negotiations with bondholders prove successful and the company can capitalise its interest payments, successfully resume operations in August/September 2020, and regain a steady revenue stream over the next 10-12 months, our ratings can be increased,” CariCRIS said.