GWest founder exits, stock price goes south

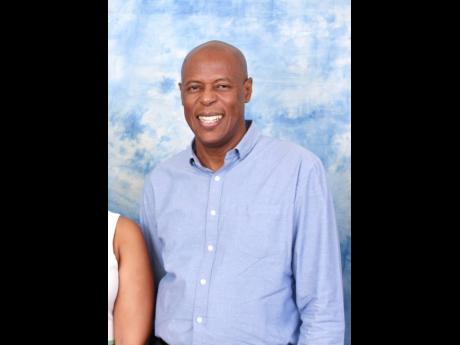

The co-founder and Executive Chairman of GWest Corporation Limited Dr Konrad Kirlew has exited the medical company, with immediate effect.

It resulted in several management changes at the loss-making company, whose stock fell to 65 cents this week, but later rallied four cents on the junior market amid the upheaval.

GWest said in a market filing that Kirlew had indicated his intention to step down as chairman by the end of the year due to extenuating personal reasons, prior to departing on a leave of absence in July of this year.

On his return, however, he advised that he was unable to continue, and would leave immediately instead, but would retain his directorship on the board.

Kirlew himself had stepped into the role of CEO last year on an interim basis, after a series of exits by persons hired to run the medical company, whose main asset is the GWest Centre, a commercial and medical complex. Marce Hayles ran the company for six months, Joy Clark for four months, and Richard Barrow for six months.

“The board of directors of GWest Corporation Limited has asked Wayne Wray, mentor, to preside over board meetings until a new chairman has been elected to that office,” the company said.

Junior market listings are targeted at SMEs, some of which are start-ups, or early-stage ventures, or family-run businesses that might need guidance on how public companies are expected to be governed. As such, their boards incorporate mentors, who are typically seasoned business or financial executives. Wray, a former banker, performed that role for GWest.

Consequent to Kirlew’s departure, Finance Director Wayne Gentles has assumed the office of executive director with overall responsibility for the management of GWest Corporation. Angella Porter has been appointed administrative manager, with responsibility for the day-to-day operations of the business, while Arden Hamilton will continue as senior accountant, GWest advised.

The GWest stock began the year at $1.18, but fared badly during the pandemic. At the onset of COVID-19, which entered Jamaica in March, GWest dropped to a low of 69 cents, rallied somewhat to as much as $1 since then, but was trading at around 70 cents in the past week. The stock closed at 69 cents on Wednesday.

The GWest Centre was developed by a group of Jamaican medical and business professionals: Dr Konrad Kirlew, Wayne Gentles, Dr Ladi Doonquah, Elva Williams-Richards, and Dennis and Denise Samuels. The modern multipurpose commercial complex in Fairview, Montego Bay, provides a range of quality medical services.

Since its market debut, GWest Corp has struggled to make a profit amid lagging revenue.

In the September quarter, the company booked revenue of $31 million, down from $35 million in the year-prior period; while it made almost as much losses at $20.3 million, compared to a $21.5-million loss then.

At half-year, April to September, revenue dropped from $69 million to $55 million, but six-month losses were less expansive this period at $37 million, compared to $42 million at HY 2019 period.

“Our reduction in revenue is mainly attributable to less client visits to the GWest facility, brought on by the restriction of movements and the socio-economic decline caused by the battle against the COVID-19 pandemic,” the company said in its earnings report.

The outlook remains “cautiously optimistic” due in part to the expected return of cruise travellers in 2021, which would augment air traveller and resident numbers in the city of Montego Bay, whose economy thrives on tourism.

“We have seen increased enquiries in leasing our investment property and we expect to see improvement in the occupancy levels in the upcoming periods,” GWest Corp said.

GWest now holds assets valued at $1.6 billion, down slightly from a year ago due to the sale of investment property. Its capital stands at $631 million, down from $673 million a year ago. The company now has accumulated losses of $66 million weighing on its balance sheet.