GM to spend more on electric vehicles, add two battery plants

General Motors will raise its spending on electric and autonomous vehicles and add two United States battery factories as it gambles that consumers will eagerly switch from gasolene to the new technology.

The announcements Wednesday came as cross-town rival Ford said its entire Lincoln luxury brand line-up would be electric or gas-electric hybrid by 2030, including four fully electric vehicles.

For months, the automakers have been one-upping each other with electric vehicle announcements, which have fuelled stock price increases for both companies.

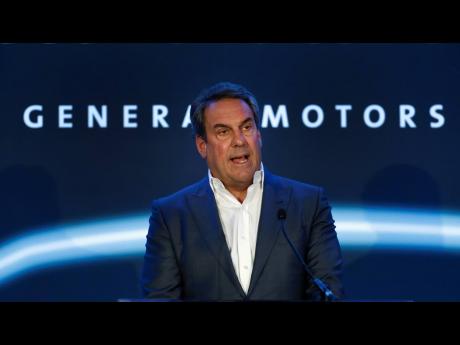

GM wouldn’t give details about where it will build the new plants, but Chief Financial Officer Paul Jacobson said they would be similar in size to two factories now under construction in Lordstown, Ohio, and Spring Hill, Tennessee. Those factories each will employ more than 1,000 workers and cost about US$2.3 billion.

The new plants were to come later in the decade, but now have been pulled forward and are expected to be in operation around 2025. They are part of GM’s plan to spend US$35 billion on electric and autonomous vehicles from 2020 to 2025. The company also said it will switch more US assembly plant capacity to electric vehicles, but gave no details Wednesday.

GM has previously said it would spend US$27 billion on electric and autonomous vehicle development by 2025 as it rolled out 30 new electric vehicles worldwide. Jacobson said the company would increase the number of electric vehicles but gave no details.

Electric vehicles accounted for less than two per cent of US vehicle sales last year, largely in luxury brands. But industry analysts are predicting big growth later in the decade as EVs move beyond tech-savvy early adopters.

Jacobson said GM is seeing success with its a new version of its Chevrolet Bolt hatchback and a new Bolt small SUV, giving it confidence that electric vehicle adoption is reaching an inflection point. “The Bolts have done well for us,” he said. “This is really no-regrets capital. We know that we will need those battery plants as we further our goals.”

Also Wednesday, GM raised its first-half pretax earnings guidance from US$5.5 billion to between US$8.5 billion and US$9.5 billion, with net income of US$6.2 billion to US$7 billion.

On a conference call with reporters, Jacobson said the increase comes as GM continues to see strong demand for its vehicles, and because it has been able to mitigate production losses due to a global shortage of computer chips. He said the company remains cautious about the full year.

GM also announced more deals to sell its battery and hydrogen technology to other companies. GM said it will build two electric vehicles for EV and hydrogen partner Honda, and it will supply hydrogen fuel cells for Liebherr Aerospace. Earlier the company said it would supply batteries and fuel cell technology to Pittsburgh-based locomotive maker Wabtec, and it would supply fuel cells to heavy truck maker Navistar.

Ford said Wednesday the Lincoln brand’s first fully electric vehicle will go on sale next year, but gave no details. The company said that by mid-decade it expects that half of Lincoln’s global sales will be zero emissions vehicles.

AP