Clarke: Government to resist election overspending

Jamaica now faces the challenge of resisting overspending during upcoming elections which could erode the gains of increased fiscal surplus and reduced debt levels since the pandemic. Local government elections are coming this year with general...

Jamaica now faces the challenge of resisting overspending during upcoming elections which could erode the gains of increased fiscal surplus and reduced debt levels since the pandemic.

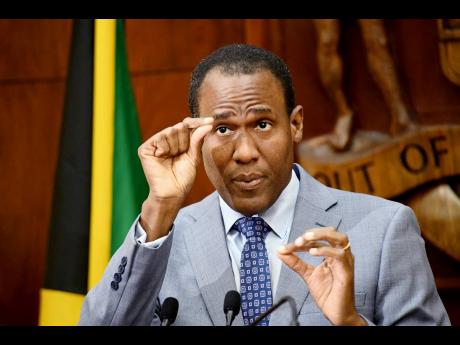

Local government elections are coming this year with general election constitutionally due in 2025. However, there are institutional checks on overspending, Minister of Finance and Planning Dr Nigel Clarke said on Wednesday at the monthly forum hosted by Mayberry Group.

“The Auditor General has two weeks to review the budget and to issue a certificate that the parameters of the budget are consistent with fiscal rules,” Clarke said.

The fiscal rules are enshrined in law passed in 2014 to guide Jamaica towards sustainable debt levels of 60 per cent debt-to-GDP output by 2028.

Jamaicans refer to election overspending as ‘running with it’, a neologism coined from the actions of Dr Omar Davies, former finance minister in the 1990s and early 2000s under the then P.J. Patterson-led administration. The spending in those years has been cited by critics as turbo-booster for an already-heavy debt load arising from the cost of rescuing the financial system during a series of bank and insurance company failures. The counterargument, however, was that ‘running with it’ allowed ongoing capital projects to continue unabated without delays.

But having gone through periods of economic crisis, requiring rescue from the International Monetary Fund in the past, Jamaica began imposing discipline on its spending habits via legislation.

“The law empowers the Auditor General to call it out,” Clarke said.

Soon, the budget-watching remit of the Auditor General will move to a newly established entity called the Office of the Fiscal Commission.

“We are in the process of building out the independent Fiscal Commission. A commissioner has been appointed and as soon as his office is functional, up and running, staffed, and ready to go, then that responsibility will move from the Office of the Auditor General to the Office of the Fiscal Commissioner,” Clarke said.

Government now spends about one-quarter of the tax revenue it receives to pay down debt. That’s coming from more than half in recent years, the finance minister said. This allows for vastly more sums to be spent on capital and social projects.

“There was a time not long ago when Jamaica’s interest cost was 16 per cent of GDP. For context, our tax revenue was roughly 27 per cent of GDP. So, when you have to take 16 points for interest it is calamitous,” Clarke noted.

“It is now about five points of GDP,” he said, adding that even the reduced level was higher than optimum.

For instance, the United States spends about two points on interest, he said.

Over time, the high debt has retarded economic growth by reducing government spending on capital projects, and inadvertently creating barriers for private-sector investments.

Jamaica’s debt load currently hovers at 74 per cent of GDP, down from 110 per cent of GDP in 2020 at the onset of the pandemic, Clarke said.

Jamaica’s growth rate spiked in recent times due to recovery from the pandemic, which decimated the economy. However, the legacy of low growth will resume in 2024, with projections of 1.9 per cent economic expansion. That’s below the 2.6 per cent growth projected for the Caribbean region, when excluding oil-enriched Guyana, which is projected to grow by an outsized 29 per cent, according to new United Nations data.

That said, Jamaica is currently experiencing 10 consecutive quarters of economic growth. It is the second-longest span since quarterly records began in 1997, Clarke said. The longest stretch was 19 quarters of growth and a flat 20th quarter from the first quarter of 2015 to last quarter of 2019, he told the forum.

Additionally, Clarke indicated that Jamaica ran its first current account surplus in over 30 years. The balance of payments is a “critical” gauge of stability, capturing the balance of trade of goods and services between Jamaica and the rest of the world.

“On services, we kind of killed it, so to speak, because of the performance of tourism. And on goods, we tend to have a trade deficit. But the important statistic is the sum of these, including remittances,” he said.

Clarke said that Jamaica now boasts four pillars of macroeconomic stability which will allow it to economically rebound quicker from shocks, namely: central bank reserves, price stability, lower debt, and financial sector stability. This is the first time since the 1960s that all four elements of a stable macroeconomy are present, he posited.

It is what distinguishes the current era from the past, he added.

“We have learnt from our experience that when you lose stability it is very hard to return. And we lost macroeconomic stability for nearly five decades,” he said.

Clarke said it took around 14 years, to 1989, for the economy to return to 1975 levels, following the 6.5 per cent contraction from the oil shocks; then 11 years to 2019 for the economy to return to 2008 levels, following the 3.5 per cent contraction brought on by the global financial crisis; and three years for the economy to return to 2020 levels, following the 10 per cent decline arising from the COVID-19 pandemic.

“We will not be able to get away from economic shocks. That has been our history, and it will continue to be our experience. The difference must be that the economy is resilient enough and allows for the flexibility to respond in targeted and temporary ways when we face economic shocks,” said Clarke.

“The benefits of resilience are obvious. The benefits of macroeconomic stability are abundantly clear,” he said.

Clarke said that during the financial shock of 2008, a total of 150,000 jobs were lost over the ensuing four years; during COVID-19, Jamaica lost a similar 150,000 jobs in four months.

“We were able to recover lost jobs within a very short period of time, and the job numbers are larger than the number of persons employed prior to COVID-19,” Clarke said.