As the need for copper rises, cable manufacturers recycle more

In an industrial suburb of Montreal, sheets of copper move along a conveyor belt suspended four stories above the floor of a foundry – a metals plant – until they drop into a lava-hot furnace. Next come pieces of discarded copper wire.

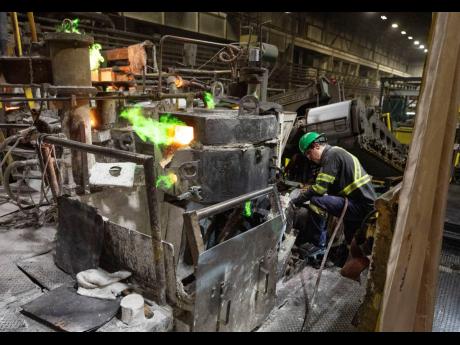

Out of the furnace comes liquid copper, alight with green fire. It travels to a second furnace and from there, a river of orange copper flows out, to be shaped into copper rods, the raw material for copper wire.

This Nexans mill has made copper rod from ore for nearly a century. But now it also makes an increasing amount of it from used copper, with the rods containing some 14 per cent recycled metal. It hopes to get to 20 per cent.

“We say to our customers: Your waste of today, your scrap of today is your energy of tomorrow, so bring back your scrap,” said Nexans CEO Christopher Guérin.

Across the industry, manufacturers have been reusing and recycling some degree of copper for many years. Now they’re stepping up these efforts as the need for the metal is projected to nearly double by 2035.

It’s partly due to a move away from fossil fuels to cut planet-warming greenhouse gas emissions. There’s a growing movement to power buildings, vehicles and manufacturing operations with clean electricity, to “electrify everything” – which uses more copper.

Building construction, cell phones and data centres account for the other half of the increase in demand.

Every ton of copper that is recycled means some 200 tons of rock that won’t need to be mined, though the amount depends on how rich the ore is. That’s important because mining can cause erosion, contaminate soil and water, threaten local biodiversity and pollute the air. Copper is an especially good candidate for reuse, because it can be recycled indefinitely without losing its value or performance, Guérin said.

Daily, up to 10 trucks drop off bare wire, cable and copper scrap at the Nexans mill. Some comes from customers, some from scrap dealers. The purity must be high if it’s to be used to conduct electricity. One of the world’s largest wire and cable manufacturers, Nexans uses more than 2,600 times the weight of the Statue of Liberty in copper each year.

People may have a closer connection to this metal and this mill than they realise – copper connects them to the world, said Daniel Yergin, an expert on energy and vice chairman of the analytics firm S&P Global.

“We depend on electricity for everything now,” he said. “None of it works without copper.”

Aluminum is used in electrical wiring too, but it takes a lot of energy to produce. Some aluminum smelters, where machines separate metal from ore, have cut production or closed as electricity prices have increased, adding to the demand for copper.

Roughly two-thirds of all the copper produced in the last century is still in use, mostly for electrical grids, home appliances and communications, according to the International Copper Association. When those get past their useful life, they are an enormous stock that can be recycled in the future, the ICA said.

Colin Williams, program coordinator for the USGS Mineral Resources Program, said companies should recycle more of the copper that is already out there, taking advantage of what is, effectively, the “urban mine.”

“It increases the supply available,” he said. “... It reduces the energy and environmental impacts associated with new mining by being able to reuse material we’ve already mined. It’s an important step.”

AP