Confidence crushed by crime and costs but not climate

Business and consumer confidence declined in the June second-quarter 2024 period due to crime and the cost of living.

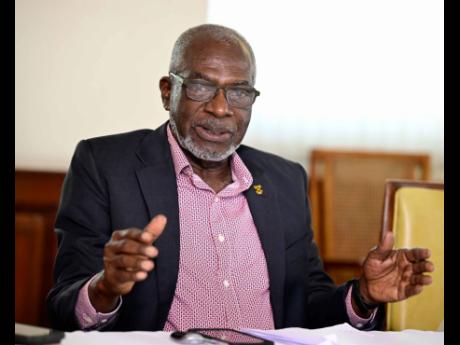

“The macro situation looks good, but in terms of [consumers] own situation, they are concerned,” said pollster and Chairman of Marketing Services Limited Don Anderson during the release of the indices by the Jamaica Chamber of Commerce on Tuesday.

Consumer confidence dipped to 169.5 points in the second quarter from 174.7 points in the first-quarter 2024, while business confidence dipped to 133 points from 139.7 points in the first quarter. The confidence indices dipped since the start of the pandemic in 2020. It recovered in 2022 but vacillated thereafter.

Anderson’s firm, Marketing Research Services, conducts the surveys on behalf of the Jamaica Chamber. The surveys interviewed over 630 consumers and 100 business respondents for the quarter. The Jamaica Chamber, in conjunction with Anderson’s firm, conducted about 90 quarters of confidence data since 2001.

The quarterly confidence indices were released under the theme ‘Navigating the Climate Horizon’. The fieldwork occurred in mid-April and mid-June, prior to Hurricane Beryl. The hotter-than-usual Caribbean Sea generated ideal conditions to turbocharge Beryl’s wind speeds.

One-third of businesses felt that Jamaica was moderately prepared for the changing climate conditions. However, two-thirds of business respondents said the country was in various stages of unpreparedness.

The world recorded its hottest temperatures on record last year. Scientists view that as a precursor for the gradual heating up of the planet due to pollution trapping heat in the atmosphere. Despite the question on climate change, Jamaicans were more concerned about inflation, lack of quality jobs, poor governance, crime, and a struggling business sector.

“People think that prices have gone up significantly, and that’s a critical factor in saying the economy will worsen,” said Anderson.

Two-thirds of consumers noted that prices have increased “significantly” when compared to a year ago, with an additional quarter noting moderate increases.

Consumers are falling behind in paying their loans, according to data from the Bank of Jamaica, which regulates the banking sector. Late payments longer than 30 days but under 90 days for residential loans, which include mortgages and credit cards, have jumped to $26.6 billion to March 2024. That’s a rise of one-third, compared to a year ago.

Anderson added that fewer persons are receiving remittances, which hints at less disposable income to offset rising prices. Before COVID-19 started in 2020, one-third of respondents received remittances and now that figure stands at roughly one-quarter, noted Anderson.

“Remittance plays an extremely important part in the lives of our people,” he said, explaining that half of those receiving remittances spend it all on household bills. “It cushions the consumer in their ability to meet daily household expenditure. So, when remittances fall, consumers feel the pinch.”

More than half of businesses and consumers cited crime and violence as the most critical issue facing the country. Also, most business respondents expect crime to worsen in 12 months. Respondents cite quality jobs as the main solution to crime. Also, one in five businesses expect things to get worse over the next 12 months. Why: Slow growth, inflation, crime and joblessness.

“Businesses are complaining too,” said Anderson about inflation. “Businesses are concerned. They are concerned.”

Firms planning investments are mostly in the services sector, followed by farming and agriculture. There was a fall in firms announcing investments in construction and real estate investments.