Sygnus sets target of US$1b in assets under management within three years

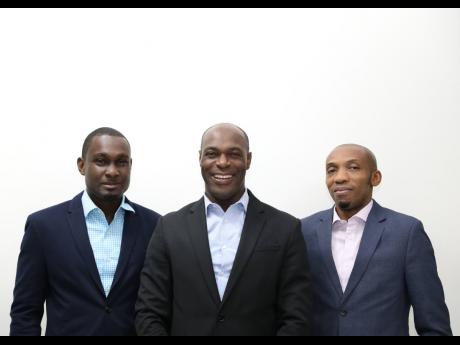

The Sygnus Group has set a target of US$1 billion in alternative assets under management, or AAUM, in another two to three years, says co-founder and Chief Investment Officer Jason Morris.

The group currently has AAUM of US$500 million, separate from the recently launched impact investment fund of over US$125 million through the operation of Acrecent, a subsidiary based in Puerto Rico.

The investment assets of Sygnus Credit Investment Limited are managed by Sygnus Capital Limited, SCL, a subsidiary of Sygnus Capital Group Limited.

The holding company has operations in Jamaica, St Lucia and Puerto Rico.

SCL is a St Lucia-registered company that’s licensed as a securities dealer regulated by the Financial Services Commission in Jamaica. It acts as the investment manager for all the Sygnus funds, including listed companies Sygnus Credit Investment Limited and Sygnus Real Estate Finance Limited, and the privately held Sygnus Deneb Investments.

Morris said that by the time the Caribbean Community Resilience Fund, CCRF, which aims to raise up to US$135 million for climate and resilience projects, and the Acrecent impact investment funds of US$125 million come together, SCL would have US$760 million under management.

“If you do the math, that will make us the largest alternative investment manager in the region,” he said.

The company wants to make a large enough impact to attract extra-regional investors, he added.

“We’re really looking at that US$1 billion over the next two to three years. That’s the goal; that’s the objective. You have to have that ambition to grow the business to that level,” he said

“We do not get anywhere close to a billion dollars without impact investing being a primary driver,” Morris said.

Key to the drive is the roll-out of the Caribbean Community Resilience Fund, CCRF, recently announced by Sygnus. The fund is sponsored by the US Agency for International Development, USAID, and the Caricom Development Fund, which already committed US$15 million. Additionally, IDB Invest has said it is considering an equity investment of up to US$5 million in the CCRF. A determination is expected around October.

“This resilience fund is bringing capital from outside the Caribbean into the Caribbean. What we’ve been doing is taking money from local sources and redeploying it into local projects, which is good, but at some point that capital is not going to be enough,” said Sygnus Group CEO and co-founder Berisford Grey.

“If we can get capital from places like New York, Europe, Asia or wherever they [investors] are to recognise that the Caribbean is an investable region, and we design these investment vehicles to help them to test the waters and put some capital to work here, over time, more investment will flow,” Grey said.

Key to unlocking the valve, he added, are properly designed and executed fund instruments. The flow of funds is needed to drive the velocity of infrastructure development and address major challenges such as climate and sustainable economic growth, Grey said.

Sygnus Deneb Investments, a private equity fund, itself has just under US$50 million deployed. Deneb funds medium-sized businesses with “patient capital”, according to Sygnus co-founder Ike Johnson.

“Whenever a company desires equity capital in their business, then Sygnus Deneb provides that capital. Every investment that we do has minimum governance requirements; so we have a seat on the board that will enable us to protect our investment,” Johnson said.

The additional reporting requirements are such that the companies involved are bound to seek board approval to sell down assets or make moves that may affect the company materially, he added.

“Deneb is focused on investing in companies at the mature or growth phase of their life cycle, that generate strong cash flow, or have the affinity to generate positive cash flow,” Johnson said.

Most recently, Sygnus Deneb was part of a Jamaican consortium led by Norbrook Equity Partners Limited, Norbrook, to take an exclusive position in fast-food franchises KFC and DQ, or Dairy Queen, restaurants in Panama. Norbrook owns 60 per cent, while Sygnus owns 24 per cent, with the other 16 per cent split between First Rock and the previous holders of the franchises.