Harold Brady charged as cops put spotlight on increasing fraud claims against attorneys

Harold Brady yesterday became the second high-profile attorney to be slapped with fraud-related charges this week, as the Police Fraud Squad revealed that since the start of the year, it has received several reports from persons complaining of being defrauded by members of the legal profession.

Superintendent Anthony McLaughlin, who heads the Fraud Squad, disclosed that a majority of these cases involve real-estate transactions and charged that some attorneys are "rinsing" their clients money for their own benefit.

"When they sell the property, they convert the monies to their own use. But once the client reports [the matter] to the police then they somehow find the money to pay," McLaughlin told The Gleaner yesterday.

"So it's a matter of them rinsing the money sometimes before turning it over to the client. They will have it in an account and keep it up to six months in the hope of making money off of it before giving it to the client," the senior investigator explained.

McLaughlin added: "So a client would conclude a deal in January and is unable to get the proceeds of the sale until somewhere after June (or) July and sometimes in excess of a year."

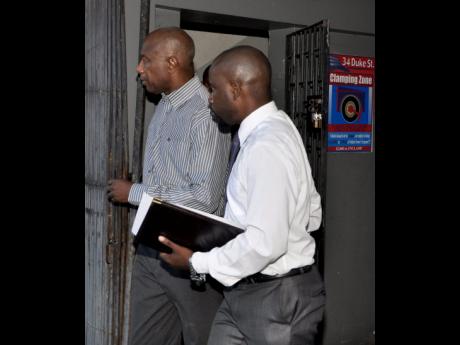

Brady, who is also a senior member of the Opposition Jamaica Labour Party (JLP), was charged with fraudulent conversion nearly two hours after he turned himself in to investigators at the Fraud Squad's downtown Kingston offices shortly after midday. He was offered bail in the sum of $3 million, but McLaughlin explained that "for the purpose of transparency" the well-known attorney would remain in custody overnight and placed before the Corporate Area Resident Magistrate's Court today.

The Fraud Squad head revealed that the allegations against Brady centre around the sale of a property which belonged to businessman Jeffrey Panton for US$610,000. According to him, the attorney turned over US$293,000 to the businessman, but US$317,000 or approximately J$37 million, remain outstanding.

However, attorney-at-law Raymond Clough, who represented Brady during yesterday's question-and-answer session with Fraud Squad detectives, told reporters that his understanding is that the outstanding sum is being held by a commercial bank.

"My client is saying that Mr Jeffrey Panton asked him to convert the money to US [dollars]. He has paid over a substantial part and the balance of the money he has converted it, but the US dollars came in and was held by the bank and it has not been released yet," Clough sought to explain.

Last night, the JLP announced that Brady had taken leave from all party activities "until his legal concerns are settled" and said it would have no further comment on the issue.

McLaughlin revealed that since the start of the year, more than five persons have come forward with fraud-related complaints against members of the legal profession. He said charges have so far been laid against Brady and well-known criminal defence attorney Michael Lorne while others have made restitution.

"And there are still others that we are investigating," he warned.

Lorne is also scheduled to make his first court appearance today.

The Fraud Squad sounded a strong warning to attorneys that monies collected on behalf of their clients should be turned over immediately.

"We have seen a lot of cases coming to the Fraud Squad against attorneys ... ; [and] once we get the reports, we are going to move swiftly to ensure that these persons are brought to book," he underscored.

It was a view shared by one senior attorney who expressed the view that clients who instruct their attorneys how to treat with the proceeds of financial transactions "were really turning that lawyer into a financial broker".

"I always tell attorneys that when they conclude a transaction on behalf of a client they should give them the money and direct them to a financial institution," said the senior attorney, who spoke on condition of anonymity.