'Grow economy with affordable housing solutions'

Two of the country's leading mortgage bankers agree that housing can be used more effectively to drive the economy.

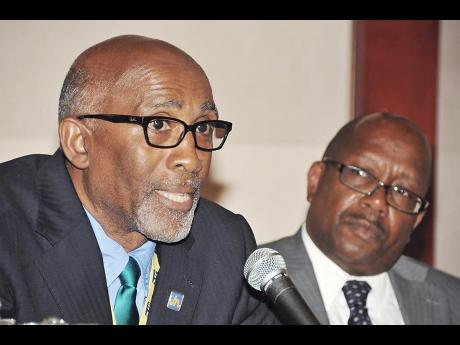

Courtney Wynter, general manager of the Jamaica Mortgage Bank, said that, compared to other countries, Jamaica is lagging behind in the contribution of mortgages to gross domestic product (GDP).

Wynter, speaking at the recently held sixth biennial Jamaica Diaspora Conference in Montego Bay, St James, revealed that the contribution of mortgages to GDP in Jamaica is about five per cent, compared with the United States of America, where it contributes approximately 70 per cent; and, Singapore, where mortgages account for about 35 per cent of GDP.

"As a society, we are not using housing and mortgages to drive the economy and grow the economy," Wynter opined. "These are some of the innovations that we can adopt in Jamaica," he added.

According to Wynter, using remittances to finance mortgages, for example, could be one of the options that mortgage institutions may need to consider to broaden access to housing.

Supporting Wynter's general position to use the housing sector as a growth area, Earl Samuels, assistant general manager at the Jamaica National Building Society (JNBS) and former managing director of the National Housing Trust (NHT), said the sector's contribution to GDP can be increased through better urban planning and stronger connectivity to critical sectors which drive housing demand.

He suggested that if housing is better tied to areas such as tourism, for example, to meet the needs of workers, then it would become a sustainable driver of the economy.

"When you're building highways, for example, you open access to new economic zones for investment, and you will need housing to support it," he noted.

Housing and the construction sectors, the JNBS assistant general manager indicated, are significant employers of persons in the skilled and low-skilled labour force and, therefore, increased activity in the sectors would have significant impact on unemployment.

Samuels, meanwhile, noted that while the housing demand is high, the effective demand is much lower as many people simply cannot afford it.

"There are many contributors to the NHT for whom, even if the interest rate for a home loan was zero per cent, they would not be able to afford it," he said.

In addition, he noted that there is also a gap between "taste" and what people can "actually afford".

"The NHT may have houses for $5 million dollars, but people don't want to live where they are located, and they may want to go to other areas where the cost of the housing unit is $15 million, however, their salaries can't meet the cost. There is a disconnect between pocket and taste," he stated.