Bank Fee Bill dumped - Gov't votes to reject proposed law

AT THE end of an arduous legislative journey, the Banking Services Bill ended up on the scrap heap yesterday after 30 Government lawmakers rejected its passage in a close vote, which saw 29 opposition legislators supporting the proposed law.

Transport and Mining Minister Mike Henry was absent, while the opposition's Denise Daley, St Catherine East Member of Parliament (MP), did not show up.

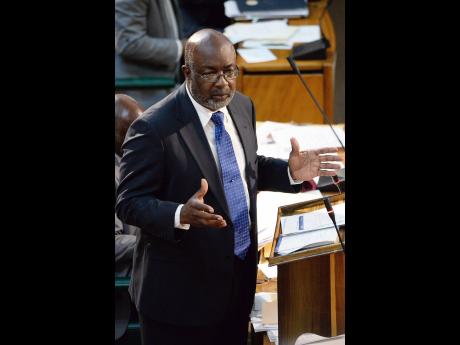

Audley Shaw, finance and the public service minister, urged Fitz Jackson, the opposition lawmaker who piloted the bill, to withdraw the measure and work with the Government in developing a framework to address the concerns he raised.

But immediately after yesterday’s vote in the House of Representatives, Jackson, St Catherine South MP, declared that the “bill will be tabled in the next legislative year”.

Making his contribution to debate on the bill, Shaw told parliamentarians that 95 per cent of the provisions in the Banking Services Bill were included in the Bank of Jamaica’s Code of Conduct for deposit-taking institutions.

“This is not a contentious issue, you know,” said Shaw, arguing that he had identified 14 provisions in the bill that the previous administration included in the Banking Services Act, 2014.

He accused the parliamentary opposition of playing politics with the bill.

“It is unfortunate that the member has sought to take the issue and seek to politicise it," said the minister. “I want to make it abundantly clear that we on this side, we too are concerned about certain fees and excessive changes in the banking system. The question is how you deal with it in a manner that is internationally acceptable and transparent.”

REQUIRES FULL COLLABORATION

The finance minister said the issue required consideration within a consumer protection framework and full collaboration with stakeholders.

“The Bank of Jamaica (BOJ) has been collaborating with other agencies and a comprehensive institutional framework to strengthen financial consumer protection,” Shaw noted.

Shaw reported that a concept paper was being worked on with a June deadline. He said the institutional framework would encapsulate provisions in the Banking Services bill but not contained in the BOJ’s code of conduct.

In closing the debate, Jackson quoted extensively from Hansard – the verbatim records of parliament – detailing the unequivocal support given by Government ministers Karl Samuda and Shaw, for the proposals to tackle the exorbitant bank fees.

Responding to Shaw’s comments that the BOJ’s code of conduct for deposit-taking institutions contained a raft of provisions in the legislation, Jackson said the “bill seeks to make certain provisions intractable in the legislation.”

Jackson argued that there was no harm in passing legislation that did not contradict any provision in existing law.

“This bill was drafted by the government’s Chief Parliamentary Counsel to ensure that there is no contradiction in legislative provision,” he pointed out.