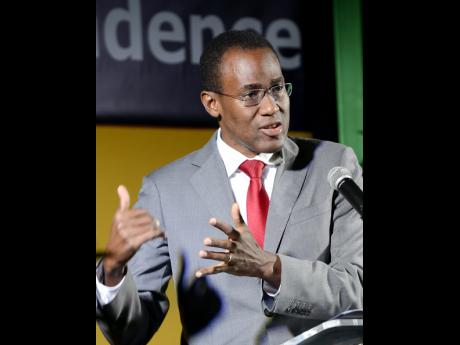

Clarke urges caution as BOJ responds to lower than projected inflation

Finance Minister Dr Nigel Clarke has cautioned Governor of the central bank Brian Wynter to carefully balance the risk of overshooting the inflation target in the future by overreacting to the country's failure to hit the four to six per cent target in June when the rate was 2.8 per cent.

Clarke's caution is included in a correspondence between him and Wynter, released to the media yesterday on the inflation rate.

Under the existing accountability framework, the Bank of Jamaica (BOJ) governor has to explain to the minister of finance the reasons for any deviation from the inflation target and how it will be met in the future.

In his letter dated August 7, Wynter argued that the lower-than-expected rate of inflation reflected a stronger-than-anticipated decline in agricultural prices in the March 2018 quarter, lower-than-projected imported inflation, and a reduction in the pass-through of oil prices to inflation.

Wynter further indicated that domestic demand conditions were also assessed to be weaker than originally anticipated.

He said that the BOJ has projected that during the September and December quarters for this year, inflation will remain close to 3.5 per cent, which would still be below the lower level of the target, but would rise to the mid-point of the target by June 2019 and remain largely at that level over the medium term.

In response, Clarke accepted that a confluence of factors, not including inappropriate policy action, led to the lower-than-projected inflation.

But the finance minister noted that those factors could be reversed by issues such as adverse weather conditions or increases in international commodity prices.

Yesterday, Clarke told journalists that he decided to make the correspondence public in the interest of transparency and in keeping with the move towards an autonomous central bank.

"As we move in that direction, I believe that information, the relevant information, is essential to the proper functioning of markets, and the greater transparency that we have, with respect to official data, the better markets will function and perform in Jamaica," said Clarke.

"The central bank's thinking on inflation is essential in the context of Government of Jamaica policy to focus on the inflation target."