Danger ‘LOOMS’ - FSC warns Jamaicans about get-rich-quick schemes as another explodes on the local scene

The Financial Services Commission (FSC) is again warning Jamaicans about get-rich-quick schemes, following the latest 'sure money' deal to emerge in the island, Loom.

Using mainly social media, the operators of Loom are promising up to 300 per cent earnings on each investment, and David Geddes, communication and international relations manager at the FSC, has warned that any investment scheme which seems too good to be true is probable not true.

"We hear reports of a lot of students being targeted and getting caught up in these things, and you see it's going to come to a painful crash," Geddes told The Sunday Gleaner.

"You remember the billions of dollars that it cost the economy when we had other similar schemes, and we haven't fully recovered from those schemes yet, so for persons to get caught up in another scheme, it is very worrying for us," added Geddes.

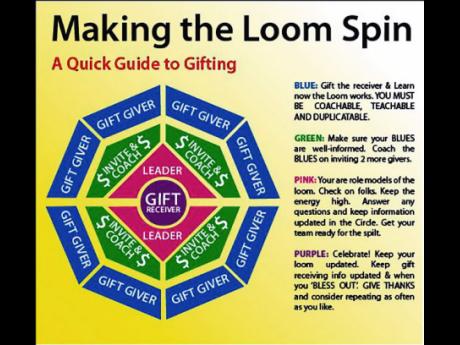

Loom, which is also advertised as the 'Birthday Club' and a 'Blessing Plan', uses mainly Instagram and Facebook or direct messages through WhatsApp to attract customers.

Persons are invited to invest as little as $5,000 and to invite at least two more persons to join. The operators then promise that after one week of the initial $5,000 investment, persons will see returns of up to $20,000.

When The Sunday Gleaner made contact with an agent of the scheme, she insisted that Loom is not a scam. According to the operator, who advertises on Instagram, she was not aware of anybody investing their money and not getting it back.

When asked about the legitimacy of the scheme she abruptly hung up the phone.

A second Loom agent told our news team that the initial investment is to be taken to a store in Half-Way Tree, St Andrew, with the investor's name, telephone number and the amount being invested attached.

He said the investor would then get a telephone call. He also listed a bank account and a money transfer service which could be used to make the investment. Calls to a phone number he provided went unanswered.

One person who has already invested in the scheme told The Sunday Gleaner that he received $35,000 on his initial $5,000 investment.

"The first time me join it, me put $5,000 and me get back $40,000 in two weeks, then me put back a $5,000, but me no get it back yet, maybe my week no come back round yet," said the investor whose name is being withheld.

According to the investor, he was introduced to Loom by colleagues at his workplace and is not worried about losing his money.

"Me never invest more than me can afford to lose."

But Geddes warned that often persons get hooked on these schemes because in the initial process, they do get money back as promised but then after a while that is no longer possible.

"At the beginning, you will find that everybody is happy, and everybody is touting the greatness of this plan, but the problem is that as it matures it reaches a level that it cannot be sustained anymore because there are just no more persons to come in.

"You are not investing on the stock market, there is nothing tangible that you can say, 'Well the money is going to this', you are just taking money from many turning it around and handing it back to a few, so what will happen is that you eventually run out of new customers and then there's a problem," said Geddes.

He said persons operating these schemes might see them as harmless, but even persons who forward the message inviting investors could be breaching the Financial Services Act.

"You are breaching the financial regulations when you are promoting products that are not licensed by the FSC, and you are encouraging persons to invest in a scheme that is not licensed by the FSC," added Geddes, as he argued that these types of schemes are very hard to police, especially if they are being done over social media.

"It's complex. First thing you have to find them in order to shut them down, and when you find them, there's a legal process. It's not like you can serve them a cease-and-desist order on a social-media platform. The person may not even be domiciled in Jamaica, so what jurisdiction do you have over the person if they are in another country," said Geddes.

He underscored that it is critical for persons who wish to invest to do so with products and persons who have been licensed by the FSC.