UWI eyes going public - VC looking positively at IPO launch but with debt concerns

A little over a week after financial and data firm Bloomberg announced the Jamaica Stock Exchange as having the best rally in the world for 2018, the University of the West Indies (The UWI) has disclosed that it is considering going public through an IPO.

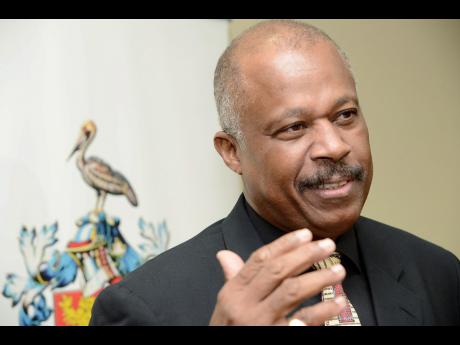

The announcement was made by UWI Vice-Chancellor Sir Hilary Beckles, responding to a question from The Gleaner while he addressed a media conference in St Lucia at the weekend.

"The university has been thinking through all the global best practices in respect of how to fund its operations and how to mobilise its resource base to generate revenue. This is a hot item, and we are working on that," Sir Hilary said.

"The question was asked before: Are we prepared to issue an IPO in respect of pursuing streams? What I can say is yes, we are looking at that, we are investigating that."

But even as the regional institution examines that option to fund its operation, the university continues to have challenges collecting its receivables, which could dampen the prospects of a successful issuance.

The collection problem, the vice-chancellor noted, has led to the university accumulating a 'public debt' of more than US$300 million.

Sir Hilary was careful to note the delicacy in approach which was required to collect those debts.

He also said that the collection problem was built into The UWI's system.

"If you issue an IPO, all of those issues come into play. So we imagine that as we resolve the collection challenge and we put measures in place to significantly reduce the collection problem that we have, our next strategy is going to be the mobilisation of our resources, our infrastructure, our earning capacities, and we will be looking very positively at the possibility of the launch of an IPO," Sir Hilary said.

INVITATION FOR AID

He added that at that time, the UWI would be inviting the skills from its alumnus and stakeholders in the financial sector to help with the IPO.

"We have reached out to them and we have said to them, 'This is your university, and all the ideas that you have available to you in terms of techniques, methodology ... let us have that conversation because we are all moving in the same direction'," the vice-chancellor also said.

The UWI is funded through Government contributions, tuition, project funds, commercial operations, investment income, and other miscellaneous income.

However, in recent times, the contributions governments make to The UWI have either been late or have declined.

The days outstanding for government contribution receivables moved from 19 days in 2007-2008 to 94 days in 2010-2011.

Additionally, the liquidity ratio moved from 6.7 in 2004-2005 to 2.6 in 2011-2012, according to the Caribbean Development Bank.