Spotlight on Montague over agencies’ $443m First Rock investment

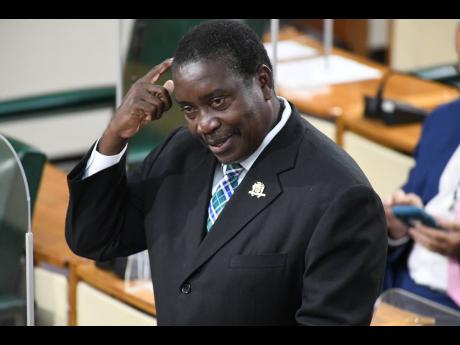

The spotlight is now on Transport Minister Robert Montague to indicate whether he is confident in the leadership of the Airports Authority of Jamaica (AAJ), which disregarded the law in a $443 million investment of taxpayers’ money in start-up...

The spotlight is now on Transport Minister Robert Montague to indicate whether he is confident in the leadership of the Airports Authority of Jamaica (AAJ), which disregarded the law in a $443 million investment of taxpayers’ money in start-up First Rock Capital Holdings.

“Prior approval was neither sought nor received … this would have been contrary to regulations,” revealed Finance Minister Dr Nigel Clarke in the House of Representatives on Wednesday.

Clarke was referring to the first set of shares (US$1 million) bought by the AAJ and the Norman Manley International Airport (NMIA) Airports Limited, a subsidiary, in February 2019. A second purchase (US$2 million) was done in January 2020.

The shares were split equally.

Julian Robinson, the opposition spokesman on finance, whose questions Clarke was answering, pressed the minister on what actions the Andrew Holness administration will take against the state-owned agencies for making an investment in a private company that was not listed on the Jamaica Stock Exchange.

That was a violation of the 2017 Public Bodies Management and Accountability Act regulations, which stipulate that public bodies must get permission from the finance ministry before going ahead with such a purchase.

First Rock became a listed entity in February 2020.

Who and how anyone will be held accountable isn’t clear as Clarke said the law does not empower the ministry to impose any sanctions nor does it include any penalty for the breach.

He said a reminder of the legislation would be issued to public bodies.

Robinson then asked Clarke whether the Government had confidence in the current AAJ board to “properly manage the funds that are under their supervision … in a case where a board breaches its own regulations”.

Clarke said he could not comment on a matter of policy related to agencies that fell under Montague’s oversight.

“The question that you posed is really a question for the minister. It’s not a question for me to answer,” he said.

NO CONFLICT OF INTEREST

Montague has not commented publicly on the issues brought to light in a Sunday Gleaner investigation in June.

However, the acting permanent secretary in the ministry, Dr Janine Dawkins, said the ministry was “satisfied” that there was no conflict of interest in the matter.

Montague was not happy when he found out about the investment, said a source at the Transport Ministry in June. The official was not authorised to speak on the issue.

“This is exactly what the minister was trying to avoid. He didn’t know anything about it. The public is going to demand more and the minister of finance must have been very happy to throw the spotlight on Minister Montague because who would want to deal with this mess?” said the official when asked for an update on the internal discussions yesterday.

“The board members who were on the boards that approved it should go. That would be good governance. There should be consequences. They essentially broke the law.”

The $443 million (US$3 million) investments took place before the current AAJ board was installed in November 2020.

The chairperson, Fay Hutchinson, has been a member of the board since 2016. She was promoted to deputy chair in May 2019 and then chair in November 2020.

It means that Hutchinson, a sales executive who has held senior positions in the ruling Jamaica Labour Party, overlapped as a director of AAJ and First Rock for a year until her resignation from the company on March 17, 2021.

First Rock announced on March 3, 2020, that Hutchinson had joined its board, just over a month after the AAJ and NMIA bought their second set of shares in the company.

Hutchinson is also a shareholder of First Rock, having bought her one million units at the same time the AAJ and the NMIA bought their first set.

She did not declare her First Rock directorship which the then AAJ board chairman, William Shagoury, has now said would have been a “conflict of interest” that he would not have tolerated.

“No,” Hutchinson told The Gleaner in June when asked whether her dual roles and private interest posed a conflict of interest. “No personal benefit or interest was being derived.”

VIOLATED ITS OWN INVESTMENT POLICY

Meanwhile, the finance minister’s response has suggested that the AAJ may have violated its own investment policy, which said equity investments should be done in “blue chip” companies, firms that are well established and well recognised and with a performance record.

The St Lucia-registered First Rock, which focuses on private equity and real estate, started operations on March 15, 2019.

“It is also a matter of judgment as to whether it was prudent for a single-equity investment to absorb as much of the space allocated to equities in AAJ’s investment policy as it did, especially if that investment is an IPO [initial public offer] of a company that was in operation for only two years at the time,” Clarke said.

An AAJ statement provided by Audley Deidrick, the group’s president and CEO, had said that the investments were done “in accordance” with the policy.

At least three of the current AAJ board members - Epsi Cooper-Morgan, Pauline Bowla, and Denton Campbell - were in the positions when at least one of the acquisitions was done.

The AAJ and NMIA, the third and fourth largest First Rock shareholders, are now trying to sell their holdings, which the finance minister says shows the boards “exercising good judgment to recognise that this is the appropriate thing to do”.