Chuck floats OUR-style regulator on banks

Hints Government could pull business in fee hike furore

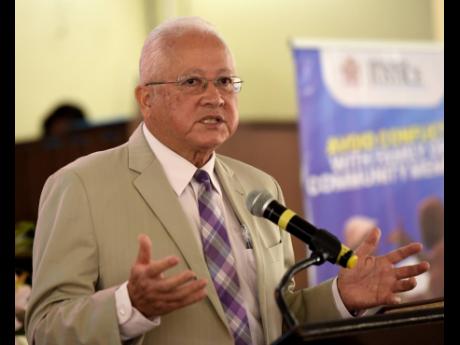

In the latest indicator of the Government of Jamaica’s shifting assertiveness on banking fees, Justice Minister Delroy Chuck has indicated that the Holness administration is not ruling out a “last-resort” formulation of anti-competition laws to...

In the latest indicator of the Government of Jamaica’s shifting assertiveness on banking fees, Justice Minister Delroy Chuck has indicated that the Holness administration is not ruling out a “last-resort” formulation of anti-competition laws to punish price-gouging banks.

The Government is also considering the establishment of a commission, similar to the Office of the Utilities Regulation, to which banks will have to make a case before they receive permission to increase fees.

Chuck has also threatened to use the Government’s muscle as the largest employer of labour to shift the accounts from which it pays public-sector employees to other financial institutions with more favourable service standards.

The aggressive pushback has been triggered by Scotiabank and National Commercial Bank’s (NCB) decision to hike rates in relation to ABM usage, including access to proprietary machines.

Though likening the stranglehold that NCB and Scotiabank have on the market as “behaving like a cartel”, the justice minister cautioned that the Government would not want to dictate the splitting up of banks.

“I don’t know if you want to break them up, which is what the United States Securities Commission does with institutions that behave like a monopoly. If that is happening, then we may well have to adopt a same stance and how it deals with monopolies,” Chuck said in a Gleaner interview on Sunday.

But Jamaica Bankers’ Association President Septimus Blake hit back at notions of collusion, saying on Sunday, “As far as we are concerned, there is no monopoly and there is no cartel. We have fierce competition between the eight firms. They make their own independent decisions.”

But that explanation did not assuage Chuck’s concerns as he lambasted the banks for what he described as the “atrocious” and “deteriorating” service.

He has also encouraged the public to move their accounts to other financial institutions to facilitate the growth of smaller banks.

“The smaller banks, especially the Jamaican-oriented banks, can appeal to the citizens and offer the services and the fees to attract more Jamaicans to their banks. So even without legislation to break them up, the behaviour of the consumer is one that can break them up,” said Chuck.

Blake, who is chief executive officer of the National Commercial Bank, estimated that currently, NCB and the Bank of Nova Scotia control 62 per cent of assets in the market combined. The market share of NCB and BNS is 38 per cent and 23.5 per cent, respectively, with Jamaica National controlling 11 per cent and Sagicor Bank controlling nine per cent.

He reiterated that the increase in fees is proportional to the additional services being offered by banks.

Currently, mobile services are experiencing the fastest growth, with more than 97 per cent of transactions taking place on digital platforms.

He is calling for a more objective analysis of banking-sector performance locally.

“The discussion and the debate, or the lack thereof, has been very emotive, and there is a need for further or deeper objective analysis of banking-system performance,” Blake told The Gleaner.

Metrics of performance that he suggests include service standards and delivery, financial soundness of banking institutions, as well as shareholder returns.

“We are not opposed to a structure or an entity that supports conduct around service standards and service level … . We have never opposed that, but the regulation of fees which are charged by different business models is where we think where we are articulating bad policy,” Blake said.

Fitz Jackson, the opposition lawmaker who piloted legislation that sought to curtail banking fees but did not receive parliamentary support from the Government, criticised Chuck for seeking to reinvent the wheel.

“The only thing that is absent is that Mr Chuck and his colleagues, including the prime minister, refused to act on the very things that they agreed to be done,” said Jackson.

The St Catherine South member of parliament explained that the Economy and Production Committee, which at the time was chaired by Karl Samuda, already examined the question of banking fees, and the report produced was agreed across party lines.

That report, he said, formed the basis of the amendments of the Banking Services Act.

The committee, which was established in 2012, comprised Samuda, Sharon Ffolkes-Abrahams, Keith Walford, Daryl Vaz, J.C. Hutchinson, James Robertson, and Andrew Wheatley of the then Opposition Jamaica Labour Party; and Julian Robinson, Richard Azan, Colin Fagan, Richard Parchment, Paul Buchanan, Mikael Phillips, and Jackson of the then ruling People’s National Party.

Some of its recommendations include the creation of a minimum service package where at least 10 transactions are allowed per month at no charge, inclusive of deposits and withdrawals, regardless of whether the deposits were done in branch or at an ATM; the creation of a consumer complaints authority; and that ATM and point-of-sale transaction fees be displayed prior to the completion of transactions.