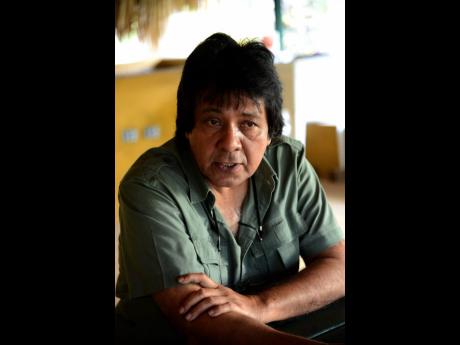

Benjamin: Not unreasonable to treat guards as contract workers

Founder and chairman of the Guardsman Group of Companies, Kenneth Benjamin, yesterday disagreed that it was unreasonable for his firms to continue to treat security guards as contract workers based on advice he had received from the income tax commissioner in 1986.

According to the businessman, his company sought the advice of the commissioner on a proposed agreement that intended for its current and future workers to be treated as independent contract workers and was informed that once the workers consented, the security companies in the group would not be under any obligation to deduct income tax from their earnings.

The agreement, which includes a stipulation for a standard rate of pay for a 12-hour shift, including four hours of overtime, was presented to security guards as a fixed-term contract for independent contractors.

During cross-examination from National Housing Trust (NHT) lead attorney John Vassell, Benjamin, who is also chairman of Marksman Limited, which is a part of the Guardsman Group, admitted that the agreement made no reference to NHT contributors.

The business further acknowledged that although the commissioner had given him that advice, which he had acted on, two ministries, in separate advisories, had notified him that the workers were employees and not contract workers.

He recalled that the minister of social security and consumer affairs had written to the company in September 1987 reminding the company of the August 1987 decision that security guards are employed persons within the meaning of the National Insurance Act.

Additionally, he also confirmed that the ministry had written to the company in the previous year asking for forms pertaining to its classification of guards and also urged it to pay over the workers’ National Insurance Scheme contributions.

Benjamin similarly recalled receiving correspondence from the labour ministry advising that the establishment of the guards fell within the scope of the Minimum Wage Act and that they were to be treated as workers.

‘WORD SPREAD’

When asked if he had relayed the information that he had received from the commissioner and the ministries to the guards, he said he had “casually mentioned” the labour ministry decision to some of the workers and the “word spread”.

However, when Vassell asked whether it was unreasonable for him to be relying upon the commissioner’s judgment, Benjamin disagreed.

“I don’t think so, sir. In that period of time, we had been having discussions with different ministers of government,” he said.

Benjamin admitted to the court that his company had challenged the ministry’s position and had sought the intervention of the finance, national security and labour ministers and was promised a joint ministerial meeting to chart the way forward.

During that time, he agreed that the NHT had written to his companies and had even given them time after the company asked for them to postpone their demand while they awaited the meeting.

Since 2007, the NHT and the security companies have been at loggerheads over their refusal to comply with the Trust’s declaration that the guards are employees, not contract workers as indicated by the companies.

The Trust has demanded that they pay three per cent of the workers’ earnings as contribution, in addition to the two per cent that is deducted from their pay.

The companies, however, have only been paying over three per cent contribution deducted from the guards’ pay while insisting that they are contract workers and, essentially, self-employed.

Consequently, the NHT, after facing opposition from several delinquent companies that were brought before the parish court, initiated proceedings against Marksman Limited to recover approximately $806 million in employer’s contribution for the period 2000-2016. The figure included interest.

The trial has been adjourned until May 11, when the attorneys for each party will make submissions.