BOJ MUM ON MONEY PRICE TAG

Central bank closes door on transparency over contract award for new currency notes

The Bank of Jamaica (BOJ) has refused to disclose the cost of financing the controversial upgrade of banknotes scheduled for release later this year.

An Access to Information (ATI) request submitted by The Gleaner for the cost to revamp the notes, first announced in Parliament by Minister of Finance Dr Nigel Clarke, was denied by the central bank.

“The contract relating to the cost of upgrading the banknotes is exempt from disclosure under the Access to Information Act,” the BOJ’s Deputy General Counsel Alvana Johnson said on April 22 in response to the request.

Johnson did not state which provision within the legislation it used to shield the disclosure of the cost.

The cost for the upgrade was determined based on bids submitted, The Gleaner was told, but details of the bids were not disclosed, nor were the names of the bidders.

Additionally, the BOJ, which is charged with the maintenance of the financial system’s stability, would not reveal who was awarded the contract.

Last Friday, BOJ Governor Richard Byles, when contacted by The Gleaner, said that he could not comment on why the request was denied, noting that it could be because of legality.

Clarke, too, denied comment on the matter.

Meanwhile, the bank said that the upgrade of the notes will be funded from its budget.

It also said that the designs formed part of the technical specifications submitted by the “selected awardee” for the works.

The bank did not state the name of the selected awardee.

“The process also involved the bank’s internal committee comprised of currency experts and was signed off by the minister of finance and the public service pursuant to Section 14(1)(a) of the Bank of Jamaica Act,” the BOJ said.

The denial coincides with Jamaica’s five-place slippage in ranking in the World Press Freedom Index.

The France-based Reporters Without Borders has ranked the country 12th out of 180 countries, down from seventh in 2021.

It also comes amid repeated concerns raised about the efficacy of the ATI Act passed by Parliament in 2002, which gives the public access to official documents held by public authorities, subject to a number of exemptions.

In February, Jeanette Calder, the executive director of the European Union co-funded Jamaica Accountability Meter Portal, disclosed that almost eight months after the entity requested information from the Kingston and St Andrew Municipal Corporation and the Department of Correctional Services, it had not received it.

The BOJ has not responded to The Gleaner’s follow-up request for additional information sent three weeks ago.

The roll-out of the upgraded banknotes is expected to coincide with the country’s 60th Independence celebration.

Clarke told Parliament, during his Budget Debate presentation in March, that the BOJ would be upgrading the look and structure of the current notes to feature all national heroes and deceased prime ministers.

The existing five banknotes feature only two of seven national heroes and three of four deceased prime ministers.

Clarke said that the current structure of the notes, which does not allow for durability, prompted the need for change.

The current denominations use a mixture of material called substrates, while the $50 and $100 notes utilise a hybrid substrate, a mixture of cotton and polymer. The $500, $1,000, and $5,000 bills are on varnished cotton.

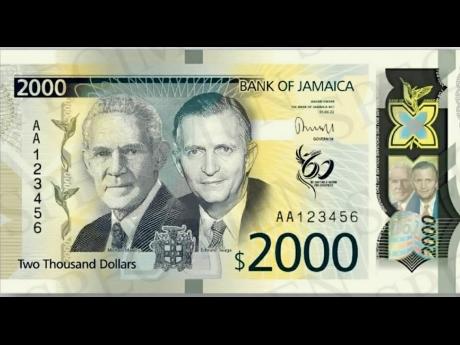

Citing that technical studies have shown that there is a need for a currency denomination between the $1,000 and $5,000 notes, Clarke announced that a new $2,000 bill, bearing the images of political rivals and former prime ministers Edward Seaga and Michael Manley, is to be released.

Manley’s family has since accused the BOJ of being insincere following Clarke’s announcement about the move.

“I consider it disingenuous in the extreme to announce to the Jamaican public a change in the look of our currency and the introduction of a new note with the phrase family approval when, in fact, some members of the families they refer to had no idea at all,” said Sarah Manley, a daughter.

She said that the family had no input in the design and called the move a “cooked up plan”.

However, a source told The Gleaner that Manley’s estate approved the design.