87-y-o widow, childhood friend among SSL suspect’s fraud victims

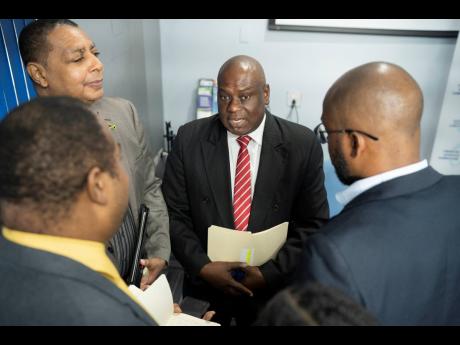

BOJ man named acting head of FSC as McFarlane quits

An 87-year-old widow and a childhood friend of the alleged schemer in the $3-billion scam uncovered at Stocks and Securities Limited (SSL) were left shell-shocked after learning that they were among dozens of account holders defrauded in one of...

An 87-year-old widow and a childhood friend of the alleged schemer in the $3-billion scam uncovered at Stocks and Securities Limited (SSL) were left shell-shocked after learning that they were among dozens of account holders defrauded in one of Jamaica's biggest financial scandals.

Already, Everton McFarlane, executive director of the Financial Services Commission (FSC), the statutory regulator for non-deposit-taking institutions, has resigned.

The senior citizen, who asked not to be identified but was listed among the victims the former SSL employee allegedly confessed to swindling, told The Gleaner that she had been trying to determine the status of her account for months.

However, she said that she was unable to get an update from the former employee, who she met through her late husband, who also held an account with SSL.

“I couldn't get any answers, and I know why now. She didn't answer, and I keep messaging asking her to let me know. I even said to her on one of the WhatsApp messages, 'I know you're busy, but ask somebody to let me have an account because I really need the funds to do something.' But I didn't get a response,” the woman said Thursday.

She said she only learnt that she had been impacted after she was contacted by her attorney three days ago and informed that her account had been defrauded.

On Tuesday, the octogenarian's name appeared on a list of alleged SSL victims that was widely circulated on social media.

She said that she had been with the investment firm before it was renamed from Paul Chen-Young & Co Limited to SSL in 2006.

“A lot of the deposits were cash. We save up and save up and carry likkle-likkle go put down,” she told The Gleaner.

“Now I don't know exactly how much I have. Sometimes she sent it (statement) in Jamaican, sometimes she sent it in US. I should have $3 million, but I don't know, so I've just prayed and left it in God's hands,” said the woman, who resides overseas.

She said that she is yet to get a status update from SSL or the FSC, which has taken control of the investment firm.

Like the senior, a businessman in his late 40s told The Gleaner on Thursday that he, too, remained in the dark about the status of his account despite several attempts to get answers.

He said that he has known the former employee since he was 10 years old.

The two grew up in the same rural community and both attended the same high school.

“I know her family. I know her dad, and part of the reason why I invested in SSL was because of her tenure there,” the man, who asked not to be identified, said.

“I am totally appalled to learn that somebody who I have known for in excess of 35 years would have done this, and I'm very much more disappointed with the response from both SSL and the FSC,” he added.

The man said when he first learnt that multi-Olympic and World Championships gold medallist Usain Bolt's SSL account had been defrauded of millions, he reached out to the former employee to ascertain if he had also been affected. He said he got no feedback from his former friend and SSL.

The man said his portfolio consisted of stocks and bonds.

He said that someone mentioned his former friend's name to him on Friday, a day after The Gleaner first reported that Bolt's account had been swindled, telling him that she was being implicated in the fraud.

“There's a sense of shock because for me, it is the loss of hard-earned savings and the loss of a friendship,” he said.

The businessman said he was on high alert and again called SSL and finally obtained a balance that did not align with the last statement sent to him by the former SSL employee.

“But I've not been able to get any official word from them ... . No one has called me to date. I am utterly disappointed. None of the institutions has reached out to me, even when you now have leaked information in the public sphere,” he said.

“The money that I see in that document, based on what I was told, seems to be underreported. At this point, I am not sure of what is fact or fiction,” he said, adding that what has been reported is half of what is missing from his account.

Additionally, he said the leaked document has made him and the other fraud-hit persons a target.

“How are average Jamaicans to trust FSC [and] the police force?” he fumed.

Finance Minister Dr Nigel Clarke told journalists on Thursday that McFarlane resigned from the post just days after The Gleaner exposed a 2017 FSC report that questioned the regulator's oversight of SSL.

The Bank of Jamaica's Chief Prudential Officer, Major Keron Burrell, will act in the position.

The FSC regulates investment houses while the BOJ oversees deposit-taking institutions such as commercial banks.

Clarke said that he accepted McFarlane's resignation, which takes effect on January 31.

McFarlane took up the post in August 2017.

On Wednesday, McFarlane told journalists that the FSC found no reason to suspend or revoke the licence of SSL even after it noted concerns about the investment firm's culture of non-compliance and mismanagement of clients' funds.