Calls for curriculum change to combat underage gambling

Some schools in denial, but 300+ students referred for betting issues last year

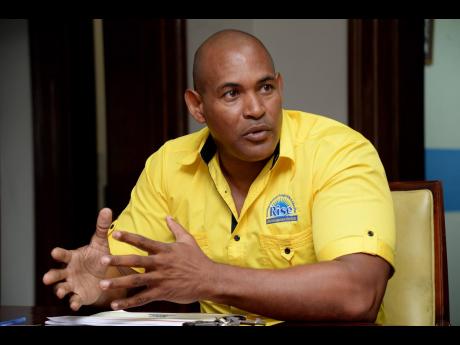

Concerned that more students are becoming attracted to and engaging in underage gambling, Richard Henry, programme manager at the RISE Life Management Services, has endorsed the proposal to make gambling prevention a mandatory part of school curricula.

“It is a problem not just because of the number; it is a problem because of the ability of the school to be able to intervene because most guidance counsellors would not have training specific to [manage] gambling addiction,” he said.

Last year, almost 300 students were referred to the organisation for treatment for gambling-related issues, Henry disclosed.

He said that while RISE Life Management Services offers training to guidance counsellors to address this issue, a curriculum that focuses on prevention would be more effective.

He posits that the syllabus should be introduced from the primary school level as “the earlier that we do these interventions and share with students the issue of underage gambling, it is more likely that they are going to be able to develop the requisite skills and be able to navigate when they go into high school”.

Henry observed that most underage gambling occurs in secondary schools and involves activities such as card games, dominoes, and betting on video games.

But acknowledging that the last study on the issue is outdated, Henry shared that RISE Life is supporting Hope Caribbean in a new study on the issue in schools.

The first and only local study on underage gambling, done in 2007, focused on the home environment.

Lorrie-Ann Vernal, head of the Guidance Counselling Unit at St George’s College, participated in a training seminar on the issue hosted by RISE Life Management Services last week.

In supporting the proposal to integrate underage gambling prevention into the curriculum, she asserted that schools will first have to accept that this is an issue.

“Given the school environment and the very aspirations, there are schools in denial, just to save face, … which really does not help,” Vernal said.

INCLUSION IN SYLLABUS

An entry point for such a syllabus, Children’s Advocate Diahann Gordon Harrison suggested, could be the health and family life education course that is taught by guidance counsellors.

“The health and family life education curriculum already deals with a number of life skill issues, … so I don’t see where it would hurt to include this, given the concern that is raised now,” she told The Gleaner.

Stating that gambling is “not for children”, she pointed to The Betting, Gaming and Lotteries Act, which makes it illegal for anyone under age 18 to participate in these activities.

Meanwhile, Vitus Evans, executive director of the Betting, Gaming and Lotteries Commission, said the agency would support such a move to combat underage gambling.

“Protecting our youth from the risks associated with gambling is crucial for fostering a healthier and more responsible future generation. We are committed to working alongside educators and our partner, RISE Life Management Services, to ensure that our children are equipped with the knowledge and tools they need to make informed decisions,” Evans said recently.

Meanwhile, lamenting that students are often mirroring life in their communities, Henry outlined that this curriculum aim to have children understand that there are “very severe consequences for being involved in gambling, probably most consequential would be the sacrificing of any goals that you have for a career”.

He added: “Our young people now live in the most legal and socially accepting [era] of gambling in Jamaica’s history. There are advertisements, they see it, they hear it, [and] those advertisements, if they don’t have the right information and understand that it’s adult business, can be a draw for them.”