Economic reforms 'solidly on track', expect temporary price rise - BoJ

Jamaica's economic reform efforts are "solidly on track", the Bank of Jamaica (BOJ) says as pressure from the phone-bill scandal bears down on Audley Shaw, the finance minister who leads the economic transformation programme.

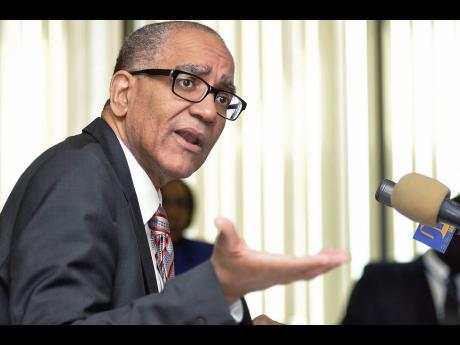

Central Bank Governor Brian Wynter, who gave the update last Wednesday to Parliament's Economy and Production Committee, said the performance is supported by "continuing strong policy implementation" under the three-year precautionary standby loan agreement with the International Monetary Fund. The deal was signed in 2016.

"All quantitative indicative targets at end-March 2017 are assessed to have been met and the country is on track to meet its programme targets for end-June 2017," stated the Recent Economic Developments and Update on the Macroeconomic Outlook report that Wynter submitted to the committee.

But the report noted that inflation, the rate of increase in the price of goods and services, will increase marginally, leading to temporary price hikes for some vegetable prices because of the flood rains in May.

The rains, it said, will have an overall impact of 0.2 percentage points on the inflation rate for the current fiscal year 2017-2018 that started on April 1.

"The rains principally affected the prices of vegetables, although the availability of all agricultural crops are likely to be affected by damage to the road network. Prices are projected to rise in April, but are expected to partially reverse within 3-6 months when the new crops mature," it said.

The Still collecting data on impact of rains - PIOJ

Planning Institute of Jamaica, which also appeared before the Economy and Production Committee, said it was yet to determine the full impact of the rains on economic growth because it is still collecting data.

However, the agency's director general, Dr Wayne Henry, confirmed that there would be "implications for Jamaica's growth in the short run".

The Bank of Jamaica conducted an inflation expectations survey in April-May and the results, the bank said, suggested that expectations remain "anchored at low levels".

The 12-month inflation rate was four per cent, which was slightly below the 4.1 per cent survey result in the March survey. It's also below the BOJ's forecast for inflation.

For this fiscal year, inflation is projected to be in the range of four to six per cent.

This, the central bank said, is mainly based on anticipated improvement in domestic demand conditions, the impact of tax measures and the level of increase in crude oil prices.

According to the BOJ, the level of inflation is targeted to "gradually decline" to levels consistent with Jamaica's trading partners in the medium term.