Contactless credit cards coming - Mastercard ready to introduce latest technology to Jamaica

No swiping, no waiting, no pin, no signature, just tap and go when paying for goods and services with your credit cards.

That is what leading global payments and technology company Mastercard is seeking to introduce to Jamaica, contactless credit cards.

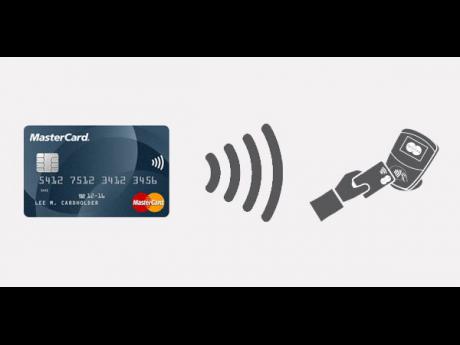

These are already being used across the world. The new card looks like a regular credit card, with an added logo resembling a Wi-Fi signal.

"Right now you have to take the card out, stick it into the terminal and pin or sign, so what we are really looking at is a simpler way to pay. So I just pull out my card, I wave it or tap it over the terminal and, depending on the amount, I don't have to do anything else.

"It's really a very fast way of paying," said Mastercard's country manager for the English and Dutch Caribbean, Ray Merceron, at the 2018 Mastercard Latin America and the Caribbean LAC Innovation Forum in Miami Beach, Florida, recently.

According to Merceron, this is the future and Mastercard is ensuring its customers are prepared for it.

"The technology is very intuitive, and I think the banks understand that we are going digital and this is really the next step to the digital transformation that the market needs.

"So we had very little pushback from the banks. All of the new terminals, even in Jamaica, are already contactless-enabled, so it's not like we have to go and replace them. They are not enabled, but they are capable, so we just need to make sure that we certify the banks and we turn on the technology on the terminals that are already ready," added Merceron.

For small transactions

He scoffed at claims that this cashless card will make it easier for fraud, as persons will not have to sign the receipts.

"Contactless is still using the EMV technology, so I cannot replicate your card. What we are doing with contactless is really to drive more of those day-to-day transactions. So a $10, a $20, that's not where the fraud is really happening, fraud is happening with big transactions.

"So we are not saying you are going to use contactless to buy a refrigerator, you are still going to chip and pin for that transaction; but your coffee on the way to work, you tap; buying your newspaper, a loaf of bread you tap instead of putting in the chip. It's for fast, everyday transactions that we are really looking to simplify the payment process," said Merceron.

Merceron, also expressed concern about the pace in which Jamaica is moving in terms of digital security.

"Digital security is something that I would want Jamaica to get on board with. As we are going into this digital space and this digital era, we are seeing those transactions grow a lot faster than our traditional transactions.

"We need to make sure that everybody is putting the right infrastructure in place so that those transactions are as safe, if not safer, than the traditional transactions. So that's the work we are doing with a lot of our customers in Jamaica to be able to get to a level where everybody is comfortable with digital transactions," Merceron told The Gleaner during that Mastercard Latin America and the Caribbean Innovation Forum in Miami Beach, Florida, recently.