Bunting alarmed at FSC powers but Samuda downplays concern

The parliamentary Opposition has raised concerns about several clauses of the Trust and Corporate Services Providers (Licensing and Operations) Regulations Bill before the Senate, arguing that they give unlimited powers to the Financial Services Commission and usurp the role of the Parliament.

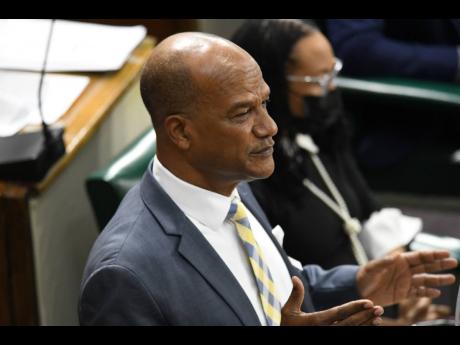

Questions have also been raised about the legality of the regulations under several clauses, including Clause 3 (1) (j), which Peter Bunting, leader of opposition business in the Senate, has described as a “catch-all”.

The regulations are aimed at preventing the misuse of business arrangements as avenues for illicit acts, including money laundering and terrorism financing.

They are also expected to prevent criminals from exploiting trust and corporate service providers in a bid to retain control of proceeds from their crimes through shell companies or trusts while hiding the source and true ownership of assets.

Bunting said his challenge with Clause 3 (1)(j) is that it requires the mandatory submission of any document or information requested by the commission from applicants.

“While the original act required affirmative resolution by Parliament, what you’re essentially doing is that it will only require it once. Because having put this clause in the first affirmative resolution, it means going forward, it will be entirely left to the discretion and determination of the commission, without parliamentary approval,” Bunting said on Friday.

“That doesn’t seem to me to be faithful to the intention of Parliament, to the law which was passed, which originally required these regulations to come back to Parliament via affirmative resolution for approval,” he added.

He took issue as well with Clause 9 (1)(k), related to the register of beneficial owners, which also requires the mandatory submission of any document or information requested by the commission from applicants.

He said, again, that the commission has been given powers that are outside of the oversight of Parliament. That, he argued, creates the framework for the commission to be intrusive in requesting information that the Parliament may not feel comfortable with it acquiring.

“I think it is incumbent on me to point out and ask you to consider that with these catch-all clauses, we are basically saying that Parliament will have the oversight once ... . We should be advised whether this may not be an overreach and may technically not be unlawful,” Bunting said.

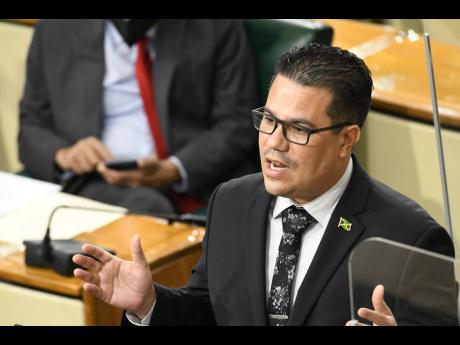

But acting leader of government business in the Senate, Matthew Samuda, said that the two clauses identified by Bunting are not as open-ended as they appear when read in isolation from the bill.

He said the clauses are limited to the intent of those two particular subsections.

Samuda explained that the regulations are crafted in anticipation of new forms of documents such as identification, for example, which may come into play internationally with the continuous advancement in technology.

“There are types of documents that we may not be able to anticipate existing next year or the year after, where it would be inefficient to just add a type of document or a type of ID or a type of space to be coming back to the Parliament in that sort of manner,” he said.

“It doesn’t change the intent of the legislation. That’s not my reading of it, and that’s not the legal advice.”