Court battles in financial sagas over the years

FINSAC chairman ousted because of conflict of interest

A legal battle was waged in 2010 against the FINSAC Commission of Enquiry and in particular against the financial status of the then chairman.

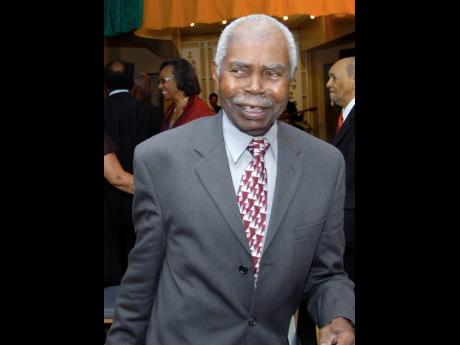

Arising from the legal challenges, retired Court of Appeal Judge Boyd Carey, who was appointed chairman on January 12, 2009, was ousted in September 2010 following a ruling by the Judicial Review Court that he was a Financial Sector Adjustment Company (FINSAC) debtor and therefore could not preside over the enquiry.

The claim against Carey (now deceased) was brought by former Finance Minister Dr Omar Davies, former Financial Secretary Shirley Tyndall, former FINSAC managing director Patrick Hylton, and the Jamaican Redevelopment Foundation.

The claimants stated that Carey had an overdraft with the collapsed Century National Bank, which was taken over by FINSAC. They contended that there would be an apparent bias if Carey continued to preside in the enquiry which began in September 2009.

Lawyers representing the claimants had made a call in January 2010 for Carey to step down but he argued that he had no debt with FINSAC and refused to recuse himself. The claimants went to the Supreme Court in February 2010 and got an order staying the enquiry until the court made a ruling in the matter.

The Judicial Review Court ruled in 2010 that Carey should not sit on the enquiry. The court made a declaration that Carey, “by virtue of his being a delinquent borrower whose debt was handled by FINSAC, is presumed to be affected by bias and is automatically disqualified from being a member of the Commission.”

Carey appealed and it was dismissed by the Court of Appeal in July 2011.

The Commission was then chaired by chartered accountant Worrick Bogle.

King’s Counsel R.N.A. Henriques, who was counsel to the commission, was also ousted by the Judicial Review Court because he had connections with a company which had dealings with FINSAC.

He appealed and the Court of Appeal upheld his appeal.

Fight to get FINSAC report

Milton Baker, one of the members of the Association of Finsac’d Entrepreneurs (AFE), took the commissioners of the Financial Sector Adjustment Company (FINSAC) to the Supreme Court in 2013.

Baker was seeking an order to compel the commissioners to produce an interim report arising from the FINSAC Commission of Enquiry, which ended in November 2011. Baker contended that the commissioners had more than enough material to prepare the report.

However, the court ruled in August 2013 that it did not have the power to compel them to produce the report. Justice Marva McDonald-Bishop (now an appellate judge), in turning down Baker’s application for leave to go to the Judicial Review Court, said the commissioners were only answerable to the governor general.

Baker, a businessman, had lost more than $150 million after two of his properties were foreclosed during the financial sector meltdown of the 1990s.

The commission was set up by the Government in October 2008 to review the 1990s financial sector collapse and how the crisis was handled by the special bailout vehicle, FINSAC. FINSAC was established in January 1997 with a mandate to restore stability to Jamaica’s financial institutions after the financial meltdown.

NCB gets major victory over Olint

A major victory was scored in January 2009 when the United Kingdom Privy Council gave the National Commercial Bank (NCB) the green light to close the accounts of embattled club Olint Corporation Ltd.

The Privy Council held that the bank’s reasons for wanting to close the accounts were valid and it was entitled to do so.

“This is a very important decision not just for NCB, but for banks and the banking system generally,” King’s Counsel Michael Hylton, who represented NCB, told The Gleaner at the time.

NCB had taken the decision to close the account on the grounds that Olint did not comply with certain requests. One of the requests was the filing of an audited financial statement.

The Court of Appeal had ruled that Olint’s accounts at NCB should not be closed. The court also refused NCB’s application for leave to appeal to the Privy Council so the bank’s lawyers applied directly to the Privy Council.

The Financial Services Commission (FSC), in March 2006, served a cease and desist order on Olint, which was headed by businessman David Smith. The order was served on the basis that Olint was trading in securities for which it had no licence.

Olint took the issue to the Supreme Court in 2007 and lost. Olint and Smith appealed, but the Court of Appeal ruled in December 2010 that the FSC acted properly when it served the cease and desist order.

Businessman’s battle against JRF

Businessman Michael Levy, a FINSAC debtor who lost a monthly income of $2 million in rental arising from the sale of his Bankhouse Mall Plaza on Manchester Road, in Mandeville, Manchester, by the Jamaica Redevelopment Foundation (JRF), said he felt “helpless” when the Court of Appeal dismissed his appeal in 2012.

Levy was involved in a legal battle in the courts since 2008 over the exemptions under the Moneylending Act, which the Minister of Finance granted to the JRF from 2003 to 2008. He filed an application in the Supreme Court seeking leave to go to the Judicial Review Court to have the exemptions quashed because he contended that they were unlawful.

Levy said he suffered financial losses as a result of the exemptions, which allowed the JRF to charge higher interest rates as well as compound interest.

The Court of Appeal dismissed his appeal and upheld a Supreme Court ruling that his application for judicial review, which was filed in November 200,8 was out of time by several years.

Levy said then that he felt helpless that he was not able to take his case to the United Kingdom Privy Council.