More multilateral money for Jamaica

The Government continues to draw down on multilateral lending facilities made easier by the standby loan agreement it has inked with the International Monetary Fund, having signed last week three policy-based loans totalling US$170 million (J$15.2 billion) from the Inter-American Development Bank (IDB). The money is intended to provide financial support to the Government's institutional reform programmes.

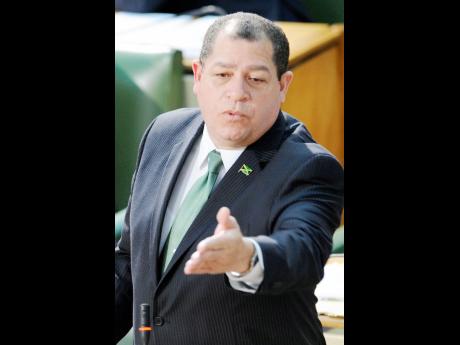

The loan contracts were signed last Friday by Finance Minister Audley Shaw and country representative for IDB, Gerard Johnson.

The loans will attract interest rate of 1.23 per cent over 20 years with payments due every six months. But actual repayment of the loan will not begin before mid-2015, Jamaica having been given a grace period of five years and six months from the date of signing.

"These three loans reaffirmed the IDB's vote of confidence in the programmes undertaken by the Government to strengthen the areas of expenditure management and fiscal responsibility, our social safety net programmes and other reform programmes to help sustain economic development," a statement from the finance ministry quoted Shaw as saying at the signing at his Heroes Circle office.

Inexpensive funding

"This partnership is a continuation of the Government's initiative to seek inexpensive sources of funding from the multilaterals," he added, noting that the funds, being for budgetary support, do not require counterpart financing.

According to the finance ministry statement, applications for another policy-based loan of US$30 million and for an investment loan of US$15 million to support the state's education transformation programme was slated to be submitted to the IDB board this week. It added that the US$170 million loan represents the first of several such loans from the IDB, totalling approximately US$600 million, expected to flow to Jamaica by the end of the year.

The three programmes under which the signed policy-based loans will be disbursed are the second phases of the public financial and performance management and the competitiveness enhancement programmes, as well as a programme geared towards human capital protection.

The Public Financial and Performance Management Programme II and the Competitiveness Enhancement Programme II will each receive amounts from the loan funds totalling US$60 million.

Tightening fiscal responsibility

The public financial and performance management project aims to assist in tightening government fiscal responsibility and easing the country's high debt burden, while the competitiveness enhancement initiative is being undertaken with the objective of combating constraints to competitiveness in Jamaica.

Under the programme competitiveness enhancement project, four main areas will be addressed, including the implementation of a competitiveness framework, tax and expenditure reform, improving access to finance, financial market development, as well as a reduction in the cost of doing business through the expedition land titling.

The remaining US$50 million of the US$170 million loan, the ministry said, is intended to shore up human capital protection spending on basic health, education and safety net programmes, as well as improving the effectiveness of welfare reforms.