Make room for Jamaican investors in big projects

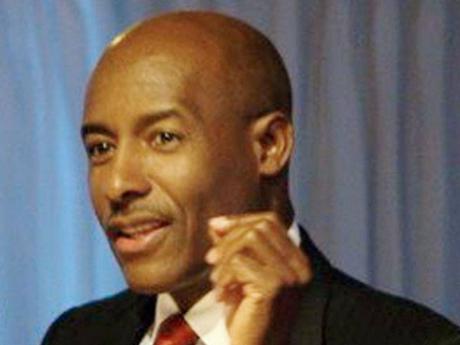

Aubyn Hill, Financial Gleaner Columnist

The economic model which I prefer is skewed to getting private investors to be the drivers of economic growth and sustainable employment.

Sure, governments have to regulate, legislate and facilitate in a timely and even-handed manner to help investors with their growth and business profitability plans, and the best results come from this balanced collaboration between government and the private sector.

When governments become the main investors and managers of commercial enterprises, one can wait a couple of years for these entities to be huge loss-making machines and unquenchable drinkers of taxpayers' subsidies.

My preferred model welcomes investors of good standing and with clean money from most anywhere. My "most anywhere" also includes Jamaica - and by extension Jamaicans.

How many Jamaican shareholders are part owners in those Spanish and American hotels on the north coast? How many individual Jamaican shareholders, individuals or corporate entities, have shares in the Jamaica Public Service Company? What about the Jamaican investor content in tenders which the Government of Jamaica opens from time to time?

MAKE IT A REQUIREMENT

One of the memorable and effective investment approaches I noticed during my 21 years as a banker in various countries in the Middle East was the requirement that most every company doing business in the Gulf Co-operation Council (GCC) countries - Saudi Arabia, Kuwait, Oman, The United Arab Emirates, Bahrain and Qatar: I lived in three of these states - had to have a local citizen, or a company wholly owned by citizens, as a local equity partner.

This was one method the governments of these countries used to ensure that some of the profits earned by business created and run by outside investors inside the GCC benefited their citizens and stayed in their countries.

Do notice that the partners generally had to be local persons, not companies owned by the governments of these states. Exceptions to this local persons rule were rare.

This model ensured that some of the wealth produced in these countries reached ordinary individuals and percolated into the broader economy.

It was well known that often the foreign investors would fund quite unsophisticated local citizens, agree to a partnership and then pay the partnership investment for the local partners and transfer the proportionate dividends to the local equity holder.

Depending on the nature of the business, the local partner - by agreement - may play some active or no role in the operations of the business. The foreign investors often use local partners to assist with ticklish labour issues or sensitive and even difficult political situations.

The quick response to my Middle East account is to dismiss it because of the oil wealth of the region and the apparent and real attraction of these destinations for foreign investors. That would be a mistake.

The 'local person' rule was pervasive and applied to all sectors, including trading in cars, food, pharmaceuticals, durable household items, the financial, construction and transport sectors, the general and oil services sectors and, of course, the oil sector.

The Al Khorafi Construction Group in Kuwait and the Saudi Binladin Group in Saudi Arabia, now the biggest construction group in the world, have all benefited from this rule.

The absence of such a formal practice in Jamaica means that nearly all the money we have borrowed and spent on projects has left little sustained knowledge transfer benefits to our Jamaican people.

These Middle East states just made it a rule and it was the price of doing business in these countries.

We in Jamaica seemed to have either not thought through how to involve local investors and so put the legal and regulatory mechanisms in place, or simply have operated from fear that the investors will walk away.

Do we really believe that a ten per cent, maybe five per cent in instances of a very large investments, no-involvement-in-management, local investor requirement is going to drive away an investor from the balance 90 per cent investment?

Investors love profits and will take 90 per cent of a good thing. Of course, local investors could be asked to take more than 10 per cent in profit.

RELUCTANT J'CAN INVESTORS

Some persons contend that Jamaicans with money are often reluctant to invest in Jamaica. I had mixed experiences with the sugar divestment exercise.

Then again, successive governments since independence have never seen it fit to make it a requirement to include Jamaicans as equity holders and thus provide an enabling environment for local investors to join their foreign counterparts as colleagues.

When a facilitating government grasps the benefits of such a policy and implements it, many local investors will react and financial institutions will likely establish funds with Glass-Steagall type separating walls to invest in these opportunities.

A related enabler would be for the government to amend the pension fund laws to allow some of the over J$220 billion held by our local pension funds to participate in these large investment opportunities and thereby broaden the universe of Jamaicans which benefits from these projects.

There are some divestments which may have to be exempted because they are unattractive. Air Jamaica was one such entity; even sugar had local investors coming forward to purchase Duckenfield and Long Pond Estates.

Once the law is in place, the Chinese investors would have no option but to comply with the law. Other upcoming asset divestments such as the Port Authority or Factories Corporation and big value road projects should require a minimum local equity holding in these transactions.

In addition to new private universities, hospitals, renewable and other energy projects, the purchasing of supplies and services by the GOJ - for those which absolutely cannot be sourced locally - should also be subjected to and governed by the local content regulation or legislation.

We have to look after Jamaicans and Jamaica's interests while complying with our treaty requirements.

Aubyn Hill is the CEO of Corporate Strategies Limited and was an international banker for more than 25 years. Email: writerhill@gmail.com. Twitter: @HillAubyn. Facebook: facebook.com/ Corporate.Strategies