Cement maker rises again on improved Jamaica, TT markets

Trinidad Cement Limited (TCL) has a bright outlook on its home market, is optimistic about Jamaica, but concerned about Barbados.

In its third quarter, the cement maker reported a turnaround from a loss of TT$11 million in the previous period to a profit of more than TT$8 million for the period ending September 2013.

Turnover for the nine months was just shy of TT$1.5 billion, from which TCL carved net profit of TT$79 million. That, too, was a turnaround from TT$183 million of losses in the 2012 period.

The company's outlook for the Trinidad and Tobago market rests, it said, on the construction projects contained with the government's newly tabled budget. Its home market, is "delivering exceptional results", which are expected to continue into next year, said TCL.

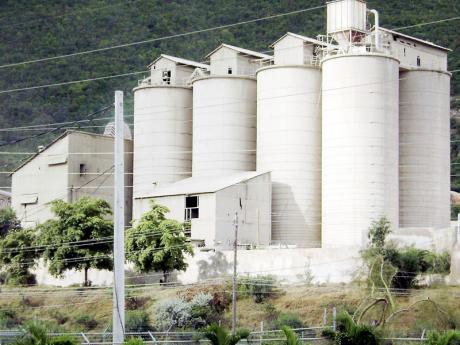

Jamaican subsidiary Caribbean Cement Company Limited broke its loss-making streak in the June quarter and maintained the trajectory in September amid signs of growth in the construction sector, including the addition of a near 12,000 jobs over the past year.

Caribbean Cement is projecting even better returns once Caracas signs off on a deal for it to sell clinker to Venezuela under the trade component of the PetroCaribe oil facility.

This time last year, Caribbean Cement was $1.45 billion in the red, now it is $31 million in the black at the nine-month mark.

Its balance sheet is still burdened by $7.5 billion of accumulated losses racked up over 12 quarters, but capital conversion of debts owed to parent TCL has given the company breathing room - negative equity of $2.9 billion at year end December 2012 is now positive equity of $4.7 billion, nine months later.

But troubles continue at the group's Arawak Cement subsidiary.

"The Barbados operations have had plant challenges for most of 2013, and results have been made worse by very low domestic demand due to the global economic crisis," said TCL in a statement from the chairman and chief executive officer.

"Critical repairs are being done in the fourth quarter 2013," the directors said.

TCL group's change of fortune follows the successful restructuring of its debt with bondholders and banking partners that recast short-term liabilities into long-term maturities. Its Jamaican subsidiary, for example, would have had to pony up $7 billion to creditors in a one-year span, but the conversion of US$75 million to capital slashed those short-term obligations to $1.7 billion at September.

Just about half of the Caribbean Cement debt, US$37 million ($3.7b), was converted to preference shares.

TCL is facing a court challenge from a group of minority shareholders on the debt-rescheduling deal, with the next legal round set for in the Trinidad High Court on December 2.