Kroger, Albertsons turn to court to save merger plan

Supermarket chain Albertsons told a federal judge Monday that it might have to lay off workers, close stores and even exit some markets if its planned merger with Kroger isn’t allowed to proceed.

The two companies proposed what would be the largest supermarket merger in United States history in October 2022. But the US Federal Trade Commission, FTC, sued to prevent the US$24.6 billion deal, alleging it would eliminate competition and raise grocery prices in a time of already high food price inflation.

In the three-week hearing that opened Monday, the FTC is seeking a preliminary injunction that would block the merger while its complaint goes before an in-house administrative law judge.

“This lawsuit is part of an effort aimed at helping Americans feed their families,” the FTC’s chief trial counsel, Susan Musser, said in her opening arguments on Monday.

Musser said Kroger and Albertsons currently compete in 22 states, closely matching each other on price, quality, private label products and services like store pickup. Shoppers benefit from that competition, she said, and will lose those benefits if the merger is allowed to proceed.

Customers also are wary of the merger, the lawyer said. In Santa Fe, New Mexico, for example, 278 shoppers wrote to the FTC to express their concerns about a combined Kroger and Albertsons, which would own five of the city’s eight supermarkets.

But Kroger and Albertsons insist the FTC’s objections don’t take into account the rising competition in the grocery sector. Walmart’s grocery sales totalled US$247 billion last year compared to US$63 billion in 2003, for example; Costco’s sales have grown more than 400 per cent in the same period.

“Consumers are blurring the line of where they buy groceries,” Albertsons attorney Enu Mainigi said.

Mainigi said Albertsons’ customers now spend 88 cents of every dollar at competitors that range from Aldi and Trader Joe’s to Dollar General. Albertsons can’t compete with larger rivals that have national scale, but joining forces with Kroger would help it do that, she said.

Kroger attorney Matthew Wolf also defended the proposed merger.

“The savings that come from the merger are obvious and intuitive. Kroger may have the best price on Pepsi. Albertsons may have the best price on Coke. Put them together, they have the best price on both,” Wolf said.

The two sides also disagree on Kroger and Albertsons’ plan to sell 579 stores in places where their stores overlap. The buyer would be C&S Wholesale Grocers, a New Hampshire-based supplier to independent supermarkets that also owns the Grand Union and Piggly Wiggly store brands.

The FTC says C&S is ill-prepared to take on those stores. Laura Hall, the FTC’s senior trial counsel, cited internal documents that indicated C&S executives were sceptical about the quality of the stores they would get and may want the option to sell or close them.

But Wolf said C&S has the experience and infrastructure to run the divested stores and would be the eighth-largest supermarket company in the US, if the merger plan goes through.

The commission also alleges that workers’ wages and benefits would decline if Kroger and Albertsons no longer compete with each other.

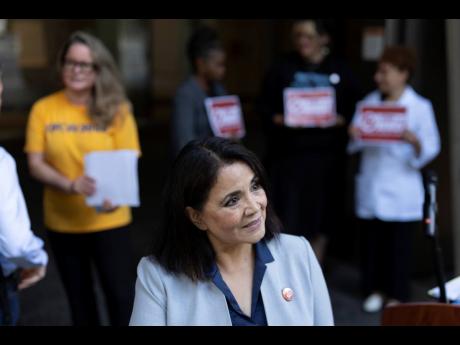

Before the hearing, several members of the United Food and Commercial Workers International union gathered outside the federal courthouse in downtown Portland to speak out against the proposed deal.

“Enough is enough,” said Carol McMillian, a bakery manager at a Kroger-owned grocery store in Colorado. “We can no longer stand by and allow corporate greed that puts profit before people. Our workers, our communities and our customers deserve better.”

The labour union also expressed concern that potential store closures could create so-called food and pharmacy “deserts” for consumers.

For people in many communities across the US, when a grocery store shutters, “their only source of food actually is walking to the nearest gas station,” said Kim Cordova, the president of UFCW Local 7, which represents over 23,000 members in Colorado and Wyoming.

Mainigi argued the deal could actually bolster union jobs, since many of Kroger’s and Albertsons’ competitors, like Walmart or Costco, have few unionised workers.

US District Judge Adrienne Nelson is expected to hear from around 40 witnesses, including the CEOs of Kroger and Albertsons, before deciding whether to issue the preliminary injunction. If she does decide to temporarily block the merger, the FTC’s in-house hearings are scheduled to begin October 1.

But Nelson’s decision will seal the merger’s fate, according to Wolf. He said the FTC’s in-house administrative process is so long and cumbersome that merger deals almost always fall apart before it’s through. Earlier this month, Kroger sued the FTC, alleging the agency’s internal proceedings were unconstitutional and saying it wants the merger’s merits decided in federal court.

The attorneys general of Arizona, California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon and Wyoming all joined the case on the FTC’s side. Washington and Colorado filed separate cases in state courts seeking to block the merger.

Kroger, based in Cincinnati, Ohio, operates 2,800 stores in 35 states, including brands like Ralphs, Smith’s and Harris Teeter. Albertsons, based in Boise, Idaho, operates 2,273 stores in 34 states, including brands like Safeway, Jewel Osco and Shaw’s. Together, the companies employ around 710,000 people.

AP