Top shareholder exits as Lumber Depot heads to market

Lumber Depot Limited, a company formed from the demerger of the hardware business from soapmaker Blue Power Group, will come to market with capitalisation of $706 million, under its initial public offering of shares, which hits the market today, November 22.

Top shareholder Antibes Holdings has gifted some shares in Lumber Depot and sold the rest of its holdings to other interests, under the agreement to take the spin-off company public.

Lumber Depot is offering just under 141.25 million shares, or 20 per cent of the business, at $1.20 per share, to junior market investors. The IPO is priced to raise $169.4 million.

Under the demerger, Blue Power will transfer to Lumber Depot all the hardware business assets as a going concern, including stock-in-trade, furniture, fixtures, fittings and equipment, goodwill, receivables and business records valued at $269.94 million.

In consideration for the assets, Lumber Depot will assume all the liabilities of the hardware business, amounting to $133.04 million, and pay to Blue Power the excess of assets over liabilities of $111.9 million in the current financial year and the balance of $25 million in a 15-month long-term loan at an annual rate of 6.5 per cent interest, with no penalty for early repayment.

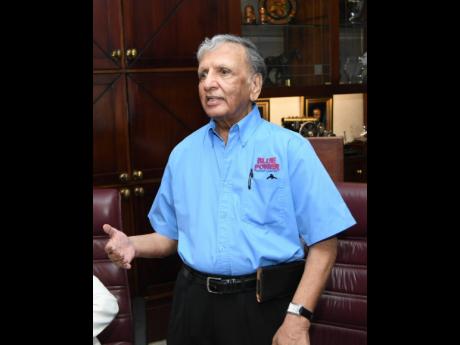

At its spin-off from Blue Power, a company founded and chaired by Dhiru Tanna, the hardware business’ yearly sales rose to $1.2 billion for the fiscal period ending April 2019, while profit after tax topped $73 million. Approximately 70 per cent of the hardware business’ revenue comes from cement, steel, lumber and paint sales.

The company expects to grow annual earnings to $166 million by year five after listing, in 2024, which it projects will come from a 15 per cent spike in sales in the first two years and 10 per cent in the out years.

Prior to the invitation, Lumber Depot had issued shares of 564.99 million, with the top shareholders being Antibes Holdings Limited, 50.09 per cent – a company connected tp Tanna and is the also the top shareholder in Blue Power Group; Mayberry Jamaican Equities, 19.91 per cent; and Kenneth Benjamin, 5.54 per cent.

After the IPO, Lumber Depot’s issued shares will rise to just under 706.24 million, with the top shareholders being Mayberry Jamaican Equities, 15.93 per cent; Blue Power Group, 15.55 per cent; while JN Fund Managers will control 11.33 per cent. Antibes, meanwhile, is exiting its investment in the hardware operation.

“The company has been notified that the exiting shareholder, Antibes Holdings Limited, has entered into agreements to sell its shares in the company on or before the listing date. The exiting shareholder has also notified the company of its intention to gift a total of up to 4.6 million units of the company’s shares to the exiting shareholder gift recipients, in varying units, at the sole discretion of the exiting shareholder on or around the listing date,” the prospectus said.

A total 3.4 million of the Antibes shares will be gifted to directors of Blue Power and the company itself, while the other 1.2 million is for specific shareholders of Blue Power.

The subscription period for the Lumber Depot IPO runs to November 29. Mayberry Investments Limited is lead broker and sole listing agent.