March date for Pulse Homes

The preliminary designs for the residences that will cut Pulse’s pathway into the residential real estate market are ready, and March is being targeted as the date to begin construction.

Pulse Homes is one end of a two-part project that modelling and hospitality company Pulse Investments Limited launched last year. The other is the development of 68 guest suites from which it hopes to generate approximately US$2.5 million in annual revenue.

Both developments are slated for the nine-acre Villa Ronai property in St Andrew. Pulse Homes will be a mix of townhouses and detached units, 30 in total, to be developed on five acres of the property and which will be marketed for sale and rental.

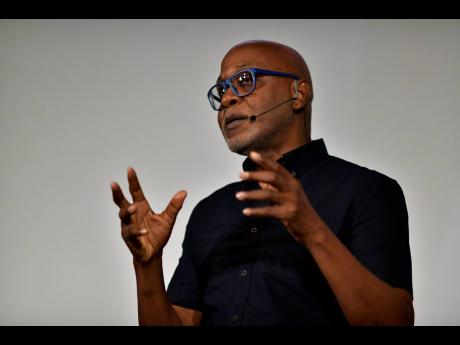

“Our plans are advanced. All major professionals and contractors are in place. Our architects are in touch with the municipal authorities as they advance schematics, and will be making submissions for building approval shortly,” said Pulse Investments Executive Chairman Kingsley Cooper.

Construction is expected to last two years, to March 2023, after which Pulse intends to put the homes designated for sale on the market at a starting price of $45 million.

“Prices have not yet been finalised, but the 30 homes are top-end units and are expected to range between $45m and $65m,” Cooper said. The prices for the rental units are also to be finalised.

Of the $250 million raised from a global bond last December, Pulse is putting the majority of that capital, $185 million, into the two Villa Ronai projects. The opening of the guest suites has been delayed to next year due to the pandemic.

FURTHER FUNDING

Pulse Homes, which got the smaller share of the apportionment, will be further funded from a mix of internally generated funds, related party funds and debt.

Pulse, which like many other hospitality business has had its revenues pressured since March owing to lockdown associated with COVID-19, but has managed to keep its earnings intact through expansion of its television shows ‘Caribbean Fashion Weekly’ and the ‘Caribbean Model Search’ reality TV series across the Caribbean and in international markets.

The company ended the September quarter with a 24 per cent jump in profit to $301 million on revenue of $166 million. Most than half of the company’s bottom line flows is linked to fair value gains on its investment properties. Cash resources at $72 million were 40 per cent lower than the cash the company had at year ending June.

“The funds were used in various ways, but notable among these was preliminary work related to professional fees and other Pulse Homes expenses,” Cooper said.

Pulse, which operates the renowned modelling agency of the same name, has expanded its business model over time beyond representation of models into what is now 14 revenue streams in the hospitality and real estate markets. Its real estate portfolio consists of shops, offices, restaurants, accommodations, event venues and hotel facilities.