Pulse closes in on acquisition of Villa Ronai property

Pulse Investments Limited, founded by its executive chairman, Kingsley Cooper, is in the process of acquiring the nine-acre Villa Ronai property in Stony Hill, St Andrew, which is also owned by Cooper and is the site being used for development of...

Pulse Investments Limited, founded by its executive chairman, Kingsley Cooper, is in the process of acquiring the nine-acre Villa Ronai property in Stony Hill, St Andrew, which is also owned by Cooper and is the site being used for development of the Pulse Suites and the upcoming Pulse Homes projects.

The acquisition is expected to be finalised before summer.

Pulse currently operates the Villa Ronai property under a 50-year lease from Cooper, who is the personal owner of the property which sits in the hills of St Andrew. The arrangement is similar for Pulse Rooms at Trafalgar, a boutique hotel operated by Pulse Investments on the edge of the New Kingston business district.

Only Villa Ronai is being sold right now, said Cooper, who, as 74 per cent owner of Pulse Investments, would still hold majority control of the property that operates in the hospitality market.

The property’s valuation and sale price were not disclosed.

Cooper said the ownership switch was critical to the company’s buildout of the planned Pulse Homes, which should come to market by 2023. Moving the property to Pulse’s balance sheet would increase the modelling and hospitality company’s attractiveness to investors when the company is in need of financing, he said.

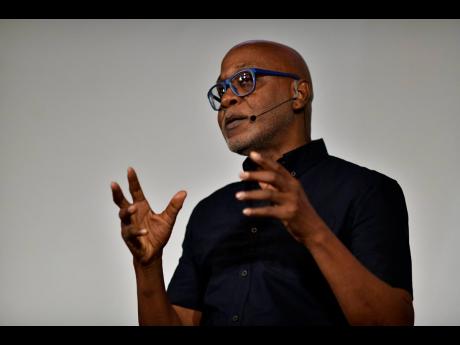

“It’s pretty much a done deal. We are just crossing our T’s and dotting the I’s,” Cooper said on Tuesday following the company’s annual general meeting, which was held at Villa Ronai.

A month ago, Pulse cleared $250 million in debt to bondholders, five years earlier than the maturity date of December 2025.

Funds from the bond were used to retire more expensive debt and to complete extensive refurbishing of the Pulse-operated Villa Ronai property in Stony Hill. Some of the money was also used for preliminary work on Pulse Homes, a 30-unit residential complex being built on a five-acre spread there.

But the company is now in need of additional funding for the completion of the real estate project, which is expected to cost $1 billion.

“The early bond payment was a side act, but now we are looking at bigger funding. We are not able to disclose those plans right now, but we should be able to make an announcement within a month or two,” Cooper said.

Like other companies in the entertainment and hospitality markets, Pulse has been challenged by the pandemic, but its September first quarter ended with strong earnings of $301 million on revenue of $166 million. The company’s profit sometimes exceeds core revenue, due to the gains that it books from its investment properties.

Its total assets were estimated at $4.9 billion, which included $72 million of cash resources.

Cooper expects business to normalise somewhat by around July of this year, but in the interim, the company has converted 10 of its Rooms at Trafalgar into office space in hopes of attracting rent from individuals working remotely.

The company, which recently completed the renovation of 66 Pulse Suites at the Villa Ronai property, units that were initially to be marketed as vacation properties, has since made minor conversions to some of the rooms to accommodate offices, shops and stores. Cooper has also noted that the company is looking to enter into one-year lease agreements with residential tenants to ride out the downturn in the hospitality market.

“We are also thinking about quarantining as an opportunity. It’s something that we are keenly looking into since we have the space and services on property that could accommodate such business. But it has to be done in a safe manner,” he said.