Strong demand boosts Wisynco profit 32 per cent to $4b

Large manufacturing and distribution company Wisynco Group has reported earnings of $4 billion for its 2022 financial year, a 32 per cent profit boost over the previous year.

Revenue from operations for the year ended June 30, 2022, was $39.1 billion, or 22.7 per cent greater than the $31.8 billion of the prior year, a performance Wisynco attributed to the double-digit improvement in performance which the company experienced in the fourth quarter of its 2022 financial year ending June. This stemmed from what company officials said was continuous growth in demand for Wisynco products, both from the local and international markets.

Earnings of manufacturing and distribution company have fluctuated over the years, its most recent dip in profit being as a direct result of social-distancing measures introduced in 2020 to slow the spread of the COVID-19 virus.

But for the 2021 year-end, Wisynco surpassed its pre-COVID-19 earnings performance, a jump that was spurred by relaxed COVID-19 measures. This year’s profit at $4 billion, came in $1.1 billion, or 38 per cent, higher than its 2019 or pre-pandemic performance.

Very encouraged

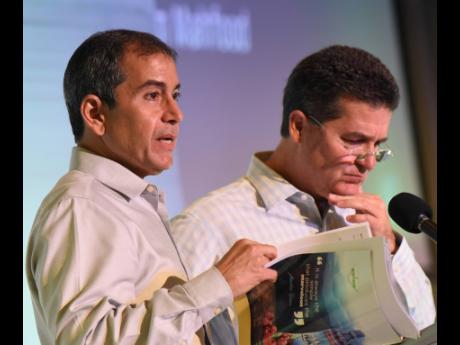

“We are very encouraged by the recovery in all sectors of the economy as we continue to invest in our business to meet the needs of our customer,” Chairman William Mahfood and CEO Andrew Mahfood said in the preamble to the company’s recently published audited financial statements.

But the year has not gone without challenges for the large manufacturer.

The company officials said that during the final quarter, Wisynco was faced with supply chain issues which affected key raw materials, some of which required special transportation equipment. That, in turn, impacted production and consequently dampened the company’s revenue levels and partly impacted gross margins, which dipped to 33.9 per cent. compared to 34.9 per cent year-on-year.

“The reduction in gross margin when compared to the prior year is due to higher energy costs, which resulted from our LNG plant experiencing downtime, and higher input costs on certain raw materials,” the Mahfoods said.

Despite the headwinds, the chairman and CEO remain bullish and revealed that the company plans to invest upwards of $5 billion in capital projects. During the year, the company is said to have placed a deposit of approximately $600 million on new equipment as it moves to expand production capacity for the upcoming financial year.

Recently, Wisynco named Sean Scott as deputy CEO. Scott moved into the newly created post on August 24 and is expected to take an active role in Wisynco’s upcoming investment projects.

Wisynco’s capital expansion programme aims to increase its production capacity and improve cost efficiencies to meet rising demand. The prospects for increased business stem from recovering hotel arrivals, rising demand for restaurant services, and schools reopening – all lucrative markets for food and drink companies like Wisynco.

On Wednesday, the company’s stock traded at $17.36. The 52-week range hovered between $15.65 and $26.90. The current price, however, is higher than it was in July 2021, when it averaged $15.78, around the same time the company diluted its shareholding by issuing a new block of ordinary shares.