Bahamas police investigating collapse of FTX

The Royal Bahamas Police Force has launched an investigation into the collapse of Nassau-based FTX to determine if “any criminal misconduct occurred”, while the main opposition has called on the Philip Davis administration “to outline to the public what financial exposures exist for the government”.

FTX moved its headquarters from Hong Kong to The Bahamas last year, with former CEO Sam Bankman-Fried describing it as “one of the few places to set up a comprehensive framework for crypto” at the time.

Prices of digital currencies fell again as the crisis engulfing the market deepened over the weekend. Bitcoin, the world’s biggest cryptocurrency, has plummeted about 65 per cent so far this year. It was trading at about US$16,500 on Monday, according to CoinDesk.

The Bahamas police announcement the investigation of FTX in a statement. The crypto business had been backed by elite investors such as Sequoia Capital, rapidly becoming one of the biggest crypto exchanges in the world.

“In light of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Limited, a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” the Royal Bahamas Police Force said in a statement.

In addition to the Bahamas probe, the US Justice Department is also investigating FTX.

Media reports in The Bahamas said the Bankman-Fried, FTX’s founder, was weathering the storm in the the luxury western New Providence community of Albany.

Last Friday, FTX filed for bankruptcy in the United States. Its collapse was preceded by the decision to lend billions of dollars worth of customer assets to fund risky bets by Alameda, Bankman-Fried’s crypto hedge fund, The Wall Street Journal reported last Thursday.

The main opposition Free National Movement, FNM, called on the Bahamian government to provide the investing public with a “clear and cogent statement” regarding FTX.

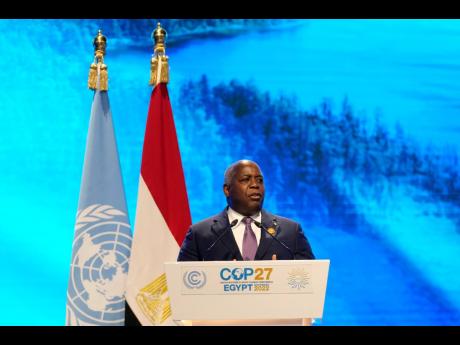

FNM leader Michael Pintard said the public needs to know what if any exposure exists for the government in view of the developments, and if there are any implications for the national budget.

In a statement, Pintard said the opposition was dismayed at the turn of events regarding the apparent collapse of FTX that had held so much promise for the future of digital asset management in The Bahamas.

“We are all shocked by the daily revelations that are now becoming known nationally and internationally and call upon the government to provide the investing public a clear and cogent statement on the matter and the steps being taken to guard against the jurisdictional fall out and to shore up investor confidence,” the FNM leader said.

“We also call upon the government to outline to the public what financial exposures exist for the government, if any, and indicate if there are any implications for the national budget. We call upon the government to confirm whether the land intended for the FTX commercial complex was private leased land. In the event that it was public land, what steps have been taken to secure the land and have it returned to its original state?”

In July, Prime Minister Davis said his government was exploring the idea of establishing a carbon exchange with FTX to trade carbon credits.

But Pintard has raised concerns about the carbon credits in view of what has transpired with the company as well as the impact of FTX’s loss.

“The government’s much-touted proposed carbon credit trading platform was announced to be facilitated through FTX’s exchange platform. Given current events, what impact will this development have on the potential for carbon trading, what alternative arrangements are being made and when will we see the first trade and benefit from this activity, if any?” he asked.

“Has the government begun to estimate the loss exposure of the private sector as a result of FTX’s apparent collapse and the personal losses of Mr Bankman-Fried and his colleagues? What measures are being taken to protect Bahamians from any anticipated loss?”

Pintard said the opposition continues to have complete faith in the Securities Exchange Commission and other relevant regulators to conduct a full and transparent investigation into what has gone wrong at FTX and to ensure that the public and investor interest is protected to the extent possible.

“In light of the fact that there are likely other companies operating in the digital assets space in this jurisdiction, what steps, if any, has the government taken to allay any concerns which may have arisen? Given the enormity of this situation and turn of events, there is an urgent need for the government to speak to this issue clearly and transparently,” he said.

CMC