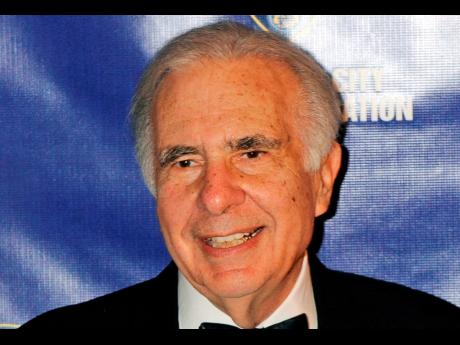

US settles with billionaire Carl Icahn for using company to secure personal loans

American billionaire Carl Icahn and his company were charged by regulators in the United States with failing to disclose personal loans worth billions of dollars that were secured using securities of Icahn Enterprises as collateral.

Icahn Enterprises and Icahn have agreed to pay US$1.5 million and US$500,000 in civil penalties, respectively, to settle the charges, the US Securities and Exchange Commission said Monday.

The agency said that from at least December 31, 2018 to the present, Icahn pledged approximately 51 per cent to 82 per cent of Icahn Enterprises’ outstanding securities as collateral to secure personal loans with a number of lenders.

The SEC said Icahn Enterprises failed to disclose Icahn’s pledges of the company’s securities as required in its annual report until February 25, 2022. Icahn also failed to file amendments to a required regulatory filing describing his personal loan agreements and amendments, which dated back to at least 2005, and failed to attach required guaranty agreements. Icahn’s failure to file the required amendments to the regulatory filing persisted until at least July 9, 2023, the agency added.

Icahn became widely known as a corporate raider in the 1980s when he engineered a takeover of TWA, or Trans World Airlines. Icahn bought the airline in 1985 but by 1992 it filed for bankruptcy. TWA emerged from bankruptcy a year later but continued to operate at a loss and its assets were sold to American Airlines in 2001. In February Icahn took a nearly 10 per cent stake in JetBlue.

Icahn Enterprises and Icahn, without admitting or denying the findings, have agreed to cease and desist from future violations and to pay the civil penalties.

In May 2023 Icahn Enterprises’ shares tumbled following a report from short-selling firm Hindenburg Research. In the report, Hindenburg claimed that Icahn Enterprises had been using inflated asset valuations. The report also pointed to “Ponzi-like economic structures” at the holding company – alleging that Icahn had used money from new investors to pay out dividends to old ones.

Icahn, in statement on Monday, hit back at Hindenburg. “After Hindenburg issued a false report to make money on its short position at the expense of ordinary investors, the government investigation that followed has resulted in this settlement which makes no claim (Icahn Enterprises) or I inflated (net asset value) or engaged in a ‘Ponzi-like’ structure,” he said. “Hindenburg’s modus operandi, which is to publish scurrilous and unsupported allegations, did damage to (Icahn Enterprises) and its investors. We are glad to put this matter behind us and will continue to focus on operating the business for the benefit of unit holders.”

AP