Jackson knocks BOJ

Opposition lawmaker says central bank was not ‘assertive’ in proposing legislation earlier to protect customers from fraud; Governor says institution is busy formulating rules to consolidate regulatory functions

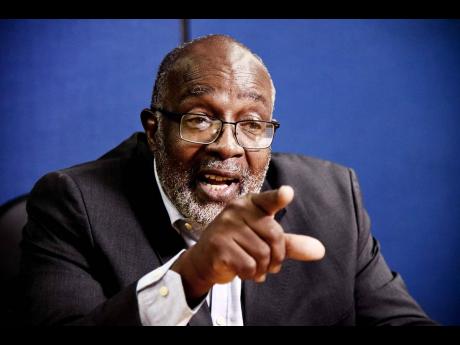

With reports from the Jamaica Constabulary Force revealing that fraudsters have fleeced more than $300 million from commercial banks over the last three years, Opposition lawmaker Fitz Jackson has chided the Bank of Jamaica for not being “assertive” as regulator in proposing legislation earlier to provide greater protection for customers of these financial institutions.

Jackson, who has been pushing for strong legislation for years to address various challenges facing customers of financial entities, argued yesterday that the central bank should have crafted interim legislation and presented it to the Government to deal with the myriad issues affecting customers of the banks.

“You must be knocking on our doors to provide legislative strengthening where they are weak, to provide new legislation where they are absent in order to fulfil your duty of protecting the public,” Jackson said during a meeting of the Economy and Production Committee of Parliament on Wednesday.

“That is my real pain, Governor, that the Bank of Jamaica is not asserting itself as the regulator of these institutions in ensuring that they protect the public. We don’t have anybody else to go to until ‘twin peaks’ is in place,” he added.

Bank of Jamaica Governor Richard Byles, who was invited to field questions from lawmakers, was at pains to point out that the institution has been working feverishly to craft legislation to deal with the consolidation of regulatory functions now shared by the BoJ and the Financial Services Commission under the umbrella of the central bank.

Finance and the Public Service Minister Dr Nigel Clarke announced early last year that legislation for this ‘twin peaks’ system should be passed this year.

Providing an update yesterday, the central bank governor said in the case of ‘twin peaks’, the BoJ had to start from scratch and “build a market conduct and customer- protection legislation as there was no real history of it.

“We don’t have a strong foundation starting from. We have had to sit and craft that then it has to go to this committee and that committee and back and to the attorney general. We have spent a year trying to get legislation to the level of Cabinet,” he told lawmakers.

Byles said he is hopeful that the draft legislation will get to Cabinet in the next few weeks.

“The process of legislation is so difficult, tedious, and time-consuming,” Byles stressed.

Jackson said he has seen financial legislation passed at ‘Bolt’ speed in Parliament.

“Legislation will take long depending on the urgency attached to it.”

He told BoJ executives that it was the job of lawmakers to strengthen the hand of the central bank so that the institution can serve the public more effectively.

Jackson said to the credit of the police force its leadership presses Parliament to make legislative changes from time to time to assist the law enforcers to carry out their duties more effectively.

The St Catherine Southern member of parliament said the banks, if left on their own, would not exert themselves to protect their customers.

He charged that there must be an obligation for the banks to safeguard the interest of their customers.

“If they don’t do it, so what! You say you are a naughty boy and they just continue what they are doing and in the meantime people are losing their hard-earned money.”

Senior deputy governor Dr Wayne Robinson said the central bank does not disagree with lawmakers on the question of duty of care and the inter-linkages between fraud risks and potential systemic risks.

“The issue and the challenge facing the central bank was the question of enforcement because that is where the rubber hits the road,” he said.

“What we are saying is that we do not have a sufficiently robust redress mechanism where consumer-protection matters are concerned,” he added.

He said a look at the Banking Services Act will show that the central bank’s ability to impose financial penalties “requires the matter to be at the level where there is a threat to systemic soundness and systemic stability of the bank or the system.

“What we are saying is that the regulation and the process need to be strengthened so that the regulator can have a more robust redress mechanism, and that is what we are pursuing under the twin-peak framework,” he said.

The Bank of Jamaica recently issued some standards and guidelines in relation to cyber risks.

Deputy Commissioner of Police Fitz Bailey, who also appeared before the committee yesterday, said 127 persons had been arrested between 2021 and 2024 for electronic fraud offences committed against customers of several banks.

He said the National Commercial Bank and the Bank of Nova Scotia suffered the greatest impact from fraudsters, accounting for 85 per cent of the reports.

Bailey said the offences are mainly done through online transfers, automated teller machines, point of sale, and wire transfers.