Family of Kevin Smith’s victim retains lawyer

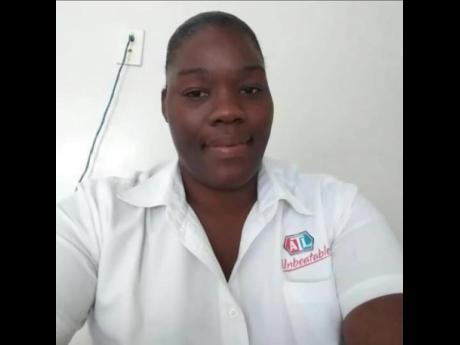

The family of Taneka Gardner, whose throat was slashed during a religious ritual at a Montego Bay-based church last October, has engaged an attorney to represent their interest in regard to the delayed payout from her life insurance policy to her son and mother, who relatives claim are the named beneficiaries.

Gardner, 39, and 38-year-old Michael Scott were killed during a sacrificial sacrament presided over by clergyman Kevin O. Smith at the Pathways International Kingdom Restoration Ministries in Montego Bay, St James. During the October 17 incident, 18-year-old Kevaughn Plummer was also fatally shot when he reportedly attacked an approaching police team with a machete.

But since her death and subsequent burial, her family said they have not been able to get any details from her employer, Appliance Traders Limited (ATL), or the insurers, Guardian Life, on the status of the undetermined claims from the policy.

This has fuelled speculations that the mother of two, like several of Pathways’ congregants, might have made changes to her life insurance and named Smith as the beneficiary.

Bizarre incident

Smith died in a motor vehicle accident shortly after the bizarre incident that rocked the nation.

But Gardner’s sister, Shelana Gardner, who is acting with power of attorney for the family, is rejecting the suggestion, despite her failed attempts to glean information from ATL and Guardian Life.

“We are having discussions with a lawyer now, because nobody going to trick us because we poor,” she told The Sunday Gleaner last week. “Because him dead, they using this Kevin Smith rumour so that they don’t have to pay us, but I will not stop until we get what is rightfully ours.”

Shelana’s interest goes beyond representing her ailing mother and nephew, as she is waiting to be reimbursed the $450,000 she spent to bury Taneka. She said there was an understanding among members of the family that she would be reimbursed when the claim is honoured, although the potential payout was never disclosed.

Michelle Johnson-Whyte, head of ATL’s human resources department, referred The Sunday Gleaner to the insurer when contacted two weeks ago, advising that the company had no further role to play in the process.

While not addressing the Gardner case, Constance Hoo, vice-president of employee benefit administration at Guardian Life, told The Sunday Gleaner that her company would only provide information on insurance policies to authorised human resource personnel of the corporate client, beneficiaries, trustees for beneficiaries or their legal representatives.

The insurance executive explained that her company normally honours claims within five to seven days after receipt of all required information and prescribed documentation. She advised that if the beneficiary also dies before the payout is honoured, the proceeds will be payable to their estate.

But with the first anniversary of Taneka’s death just six weeks away, her family is refusing to accept that she would have committed to further enrich a man that already had substantial wealth and contemptuously dictated his congregants’ personal lives to the point that they would ignore the welfare of their loved ones.

“I look at her dead body on my phone almost every day, still hoping I could get some answers as to why she did not listen,” her father Septimus Gardener told The Sunday Gleaner. “Now, even a situation that should bring some good for her son is working against him.”

Insurer’s approach

Insurance expert and Gleaner columnist Cedric Stephens questioned the insurer’s approach in dealing with the issue and charged that Guardian Life has a moral duty to advise the family of the true nature of the policy.

He noted what could appear to be “a lack of respect and empathy on the part of the insurance company to the deceased’s family members – who may or may not be the beneficiaries – and the absence of any discussion about the contractual, ethical, or regulatory duties on the parts of the insurer and the deceased’s former employer ATL”.

In the meantime, the Major Investigations Division continues its probe into Smith’s estate, with his affairs reportedly being managed by his mother who lives overseas.