Growth & Jobs | Before applying for a loan… Understand the five Cs of credit!

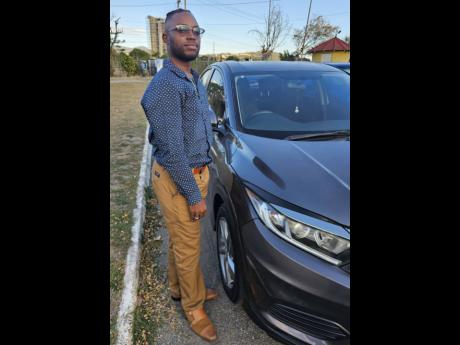

FOR YEARS, Christopher Nembhard, a music educator who works miles away from home, wanted a car to make travelling easier and his life less stressful. Because he didn’t have cash up front to buy one, he decided to get a loan to help him finance the purchase.

Nembhard, like most loan applicants, suspected the lender would require a few documents to make his dream a reality. What he didn’t know was that he would be evaluated using the ‘five Cs of credit’, which Rose Miller, financial literacy expert at JN Foundation, said everyone should be aware of before applying for a loan. The five Cs of credit are character, capacity, capital, conditions, and collateral.

“You can’t simply walk into a bank or credit union with just a photo ID or evidence of income and get a loan. You are required to pass the five Cs of credit test before being approved for a loan,” said Miller.

She said the five Cs provide lenders with a framework to evaluate a loan applicant’s creditworthiness, and in Nembhard’s case, that framework was used to determine if he could be trusted to receive new credit.

“Looking back, I realised that by considering those factors, the lender was able to assess my financial situation and determine the level of risk associated with extending credit to me,” Nembhard said.

Pointing out that one should use credit responsibly and primarily for enhancing one’s financial security, Miller shared that these individuals will likely be good candidates for credit, as they would be considered low-risk applicants. Lenders would therefore have no hesitation in approving the finance they seek.

As part of his loan process, Nembhard noted that he had to provide the lender with some Know Your Customer documents, including his driver’s licence. He also had provided documentation about the car to be purchased, and gave approval for the institution to apply for his credit report, which would provide the history of his payments and his credit score.

These, Miller said, were critical for his character test, noting that the lender used the series of information to establish how financially reliable he was, and if he would be able to pay back the money if given more credit.

Nembhard said he was also instructed to provide the lender with his most recent payslips, information about his monthly expenses and other affairs. This helped them to determine his capacity or ability to successfully repay the loan.

“To determine a borrower’s capacity, lenders typically evaluate income, debt-to-income ratio, and employment status,” Miller explained.

The information Nembhard provided also helped him to pass the capital test, which lenders use to see if a borrower is committed enough to contribute some of their own funds.

“Capital speaks to the amount of risk that a borrower is willing to take on the transaction, and whether there are any funds in reserve to support continued servicing of the debt in the event of an interruption of income,” Miller explained.

As for conditions, Miller said, this refer to the terms of the loan and could also take into account the economic conditions that exist at the time of the application. Some loan terms and conditions include the interest rate, tenure, and method of payment.

Collateral, Miller further noted, helps a borrower to secure the financing needed. She said it is oftentimes the item a person is seeking funding to purchase. “Loans backed by collateral are those we refer to as secured loans, and if a borrower defaults on payment, the lender can dispose of the collateral to settle any outstanding sums owed. This is really what makes these types of loans less risky for lenders.”

For an unsecured loan, you don’t need collateral, but she noted that the interest on those loans are higher and the borrower needs to have reasonably good credit history.

Nembhard’s auto loan was approved, which means he passed the five Cs of credit test, and he recently secured his vehicle, which he said has made “a world of difference”.

“It’s really important for us to learn how this credit appraisal process works, because with this knowledge we can understand, and even improve, our creditworthiness,” the new car owner acknowledged.

Miller said while financial institutions may evaluate the five Cs of credit differently, knowing about them can help people make sound financial choices in managing their finances, thus improving their chances of successfully accessing credit.