Deadline anxiety

Tax incentives negotiation ongoing as latest Harmony Cove groundbreaking timeline closes in

The US$1-billion Harmony Cove mega resort project, which is yet to get off the ground two decades after being launched, faces a looming threat to its 2024 groundbreaking deadline amid ongoing negotiations between the Government and its investor partner regarding tax incentives.

An updated agreement is due to go to the Cabinet this month, Finance Minister Dr Nigel Clarke has disclosed.

“The restated agreements will ultimately require the approval of Cabinet. It would be inappropriate, therefore, to project a time for signing prior to securing that approval,” he told The Sunday Gleaner.

According to Harmonisation Limited, a government company overseeing the State’s 50 per cent stake in the project, there is a “positive expectation” that the revised terms will be settled this year “with ground-breaking as soon as 12 months thereafter”.

The other half of the project is owned by Nexus Luxury Collection, a real estate and hospitality management company that Harmonisation says is a sister company of the Tavistock Group, a Bahamas-based international private investment firm.

The update comes amid frustration from some potential investors and some senior members of the Andrew Holness administration over fears that yet another timeline may be missed.

Harmony Cove was originally signed in 2006 as a joint venture between the Government and Tavistock.

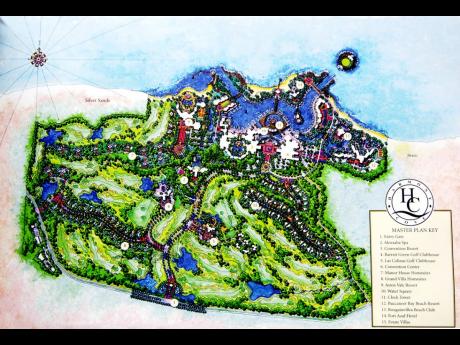

The resort is to be situated on 2,300 acres of land in Trelawny. The project, originally set to cost US$7.5 billion, was first announced by Prime Minister P.J. Patterson during his 2004 Budget presentation, but despite commitments from successive administrations, it has failed to get out of the ground. Tavistock also went through a series of financial troubles.

26-STOREY HOTEL

The development will consist of a 26-storey hotel with 1,000 rooms, a large casino, group and meeting rooms, and an 18-hole championship golf course designed and developed by Tiger Woods.

In January, Tourism Minister Edmund Bartlett said the project was being fast-tracked and ground should be broken within the next 11 months.

“There are some details still to be worked out, and while I cannot give a date for the ground-breaking, everything points to it happening this year,” he said.

And Christopher Anand, chief executive officer of Nexus Luxury Collection, echoed a similar view, adding that “we are aiming to create the most large-scale resort destination”.

The finance ministry, which leads on the project negotiations, did not make any public pronouncements on a timeline for the start of the project.

And Clarke, in his statement to The Sunday Gleaner yesterday, did not provide one. He said there are “many milestones to be achieved after the signing of an agreement, inclusive of finalisation of designs and securing of the required permits”.

“The GOJ (Government of Jamaica) and the investors are highly motivated to make this project happen, so, let’s see!” he said when asked if the 2024 deadline would be met. “What will be important is that on the signing of the updated agreements, Jamaica’s first US$1 billion tourism investment will be firmly on track. That will be a big deal.”

UPDATED AGREEMENT

The minister acknowledged that the negotiations for an updated agreement while “honouring the spirit of the original concept ... have taken time”.

“Let us face it. The structure of the tax incentives as originally conceived is, in so many ways, out of step with Jamaica’s fiscal framework today. We will not return to the era when tax incentives were provided on a company-by-company, project-by-project basis, where the rules were unwritten and unclear and the governing framework was absent,” Clarke said.

Jamaica changed its tax incentives regime over the last decade under agreements with the International Monetary Fund.

Clarke said the Government has sought to “incorporate the tax incentives into a transparent and predictable rules-based framework, creating a level playing field among investors who invest in large and/or pioneering projects, while instituting a cap on the aggregate size of such incentives outstanding at any time”.

Neither the Jeffrey Hall-chaired Harmonisation Limited nor Clarke gave specifics about tax incentives under consideration, but Harmonisation indicated that the incentives will be available to Harmony Cove Limited and entities specifically prescribed by their direct relationship to the project and investment in Jamaica.

“They (incentives) will be only available for a limited period of time and the maximum incentive in any year will also be limited. The framework that is now proposed is intended to operate as a pilot framework for other large-scale projects that can benefit Jamaica,” the company explained.

Among the considerations is how long Nexus would benefit from a waiver of corporate income tax. Currently, companies pay a corporate rate of 25 per cent, but regulated firms pay 33.33 per cent.

The Government is expected to revise the Income Tax Relief (Large Scale Project and Pioneer Industries) Act, which incentivises investments of US$1 billion or more. The benefits to be granted to Harmony Cove are slated to be rooted in those changes.

Up to May 9, investment in Harmony Cove has been limited to planning, concept design, and administration, Harmonsation said in its May 9 response to questions on the costs incurred so far. A figure was not provided.

“The Government has earmarked 2,000 acres of land for the project, and when contributed, this will constitute the major share of the Government’s contribution by way of Harmonisation Limited. This investment will be duly accounted for at the time of the capitalisation of the revised project and Harmonisation will receive shares having a comparable value. Global private investors will fund the major share of the overall project,” it added.

Harmonisation said it will take “specific steps to ensure that all entities with whom it contracts fully meet all appropriate reputational and fit-and-proper standards and, importantly, have a solid track record of successfully investing in global enterprises and working alongside major global financial institutions which themselves share an excellent reputation”.

Tavistock’s billionaire owner Joe Lewis pleaded guilty to insider trading in the United States in January. He was accused of passing on information about his companies to his private pilots, friends, personal assistants and romantic partners. He pleaded guilty to conspiracy and two counts of securities fraud as part of a deal with prosecutors.

The latest delays in the project have left some potential investors and senior government officials concerned.

Prime Minister Andrew Holness was expected to make an announcement regarding the project during his Budget Debate presentation in March, but was unable to do so, according to highly placed sources in the administration.

There was also no announcement in the opening Sectoral Debate presentation by Bartlett.

“The ball is in the court of the Ministry of Finance,” the tourism minister told The Sunday Gleaner.

“I have no idea what is holding up the project,” one official, who asked not to be identified, told The Sunday Gleaner weeks ago, noting that the company had accepted the latest reworked proposition by the finance ministry.

Nexus Luxury Collection said the project will employ some 4,000 Jamaicans at salaries much higher than what is currently being paid in the local tourism industry.

For financing, Anand said an initial public offering will be executed and Jamaicans will be able to purchase shares in the development.

“We want Jamaicans participating in this project and we believe that the best way is for them to invest in the project,” he said.

He said that small investors will also be targeted.

Jovan Johnson and Lester Hinds contributed to this story.